The most interesting ideas come about by questioning assumptions.

In science, Copernicus questioned the assumption that the Earth was fixed in the center of the universe. Newton questioned the assumption that an apply falling and the moon orbiting were related.

In government, Madison, Jefferson, Franklin, and friends questioned whether a government needed a king.

In business, Henry Ford questioned whether every automobile needed to be built by craftsmen, one at a time by hand. Michael Phillips questioned whether customers really needed to be able to withdraw all their savings at any time. Muhammad Yunus questioned whether the poor were the terrible credit risk the bankers and economists claimed.

What I’ve found in working with entrepreneurs is that many of their plans include questionable assumptions, and that having the entrepreneurs step back and question those assumptions lead to far better plans, and more viable businesses.

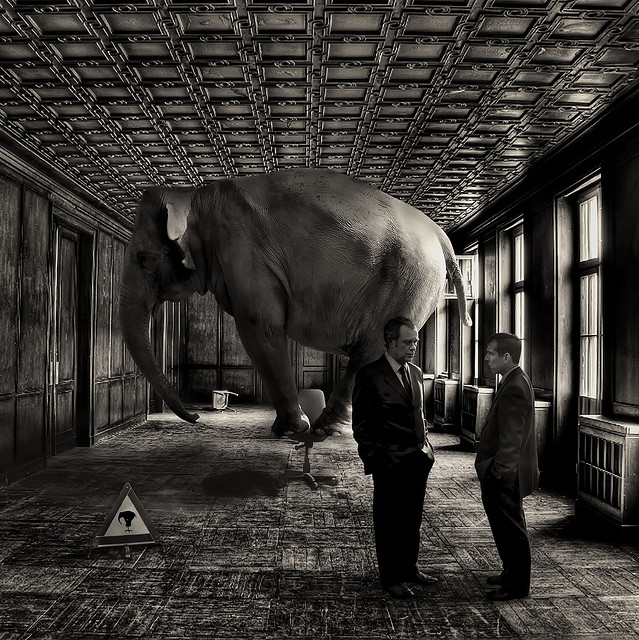

Better yet is when an assumption is brought forward that is not only taken for granted as true, but sits unseen by the masses. For example, in dozens of discussions with investors and entrepreneurs on the topic of Angel and venture capital investing, the investment thesis was always described as a variant of: huge opportunity, high growth model, and a great team to execute.

The unstated assumption in that model, as described, is that upon successfully executing that high-growth plan, that either the company will be able to IPO, or if not, then some acquirer will be there to provide an “exit”. Outside of tech, media, consumer packaged goods, and a few other markets, that assumption is not true. And without it, the investments using structures based on that thesis do not usually make financial sense.

I’ll have more to say about that specific assumption in future posts, and a lot more to say about assumptions about business that are either no longer true, or which have never been true, yet which continue to be taught year in and year out at Harvard, Wharton, Stanford, etc., and which continue to be discussed in the Wall Street Journal, New York Times, on screen on CNBC, at the Federal Reserve, and elsewhere.

Repetition may define the “truth”, but it does not make a fact or idea true.