Yesterday I attended and spoke at a great investor event set up by Element8, “Investing a World With Few Exits“. The event kicked off with an amazing summary by Rob Wiltbank, which not only reprised his conclusions from his groundbreaking research on Angel investing, but included analysis on new data sets he has been collecting.

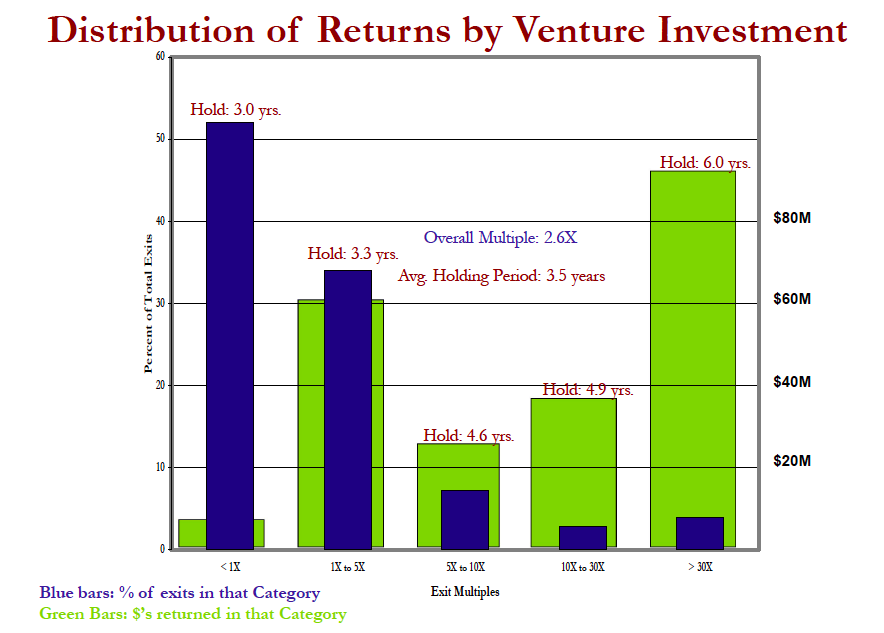

The key learning continues to hold true. In the traditional investment model, 90% of returns are from 10% of the investments, and those returns take twice as long on average to be realized than the losing and lesser returns.

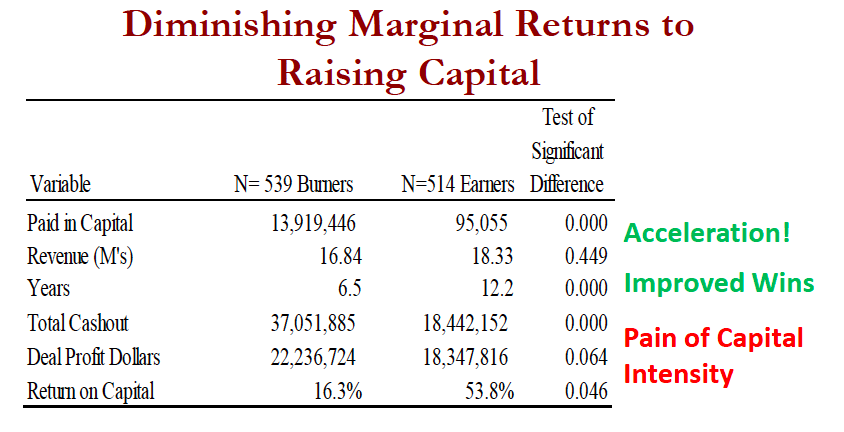

The new finding is in looking at the difference between exits for companies that raised capital vs. those that bootstrapped. In a data set of over 1,000 exits, the three surprises were that

- Funding does leads to quicker exits, 6.5 years vs. 12.2 years

- The size of exits is larger for funded companies, $37M vs. $18M

- But after subtracting the investment capital $13.9M vs. $0.1M, the return to the founders was far higher for the unfunded companies.

This analysis was based on 1,053 exits, a.k.a. acquisitions, and thus only counts the successes. The big, open question is what percentage of all funded companies (what Rob calls “Burners”) make it to any exit, and what percentage of the unfunded companies (what Rob calls “Earners”).

For investors, that isn’t a question that matters much, as by definition they can’t participate in the Earners, who by definition don’t take investors’ capital. However, for entrepreneurs, this is a key question, as for most startups, they get to choose whether to seek the Burner path.

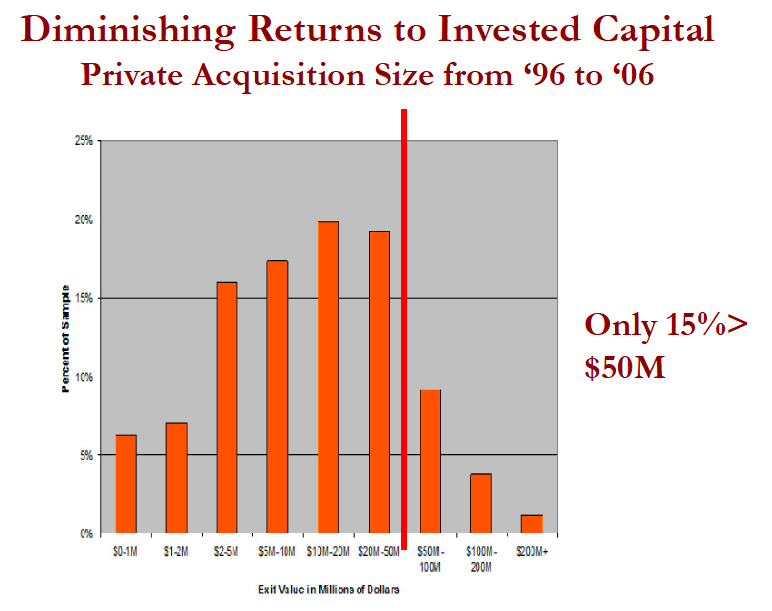

For entrepreneurs, this analysis clearly shows the key issue with raising funding. Of the average $37M price paid for success companies, most of those dollars go to the investors, not the founders. This is already well known from looking at the common pattern of dilution in cap tables, but I suspect that issue is generally glossed over, as entrepreneurs multiply their small ownership percentage by $100M or $1B, rather than $37M. Meanwhile, investors do the same for their share, despite yet-another finding from Rob’s research, that only 15% of acquisitions exceed $50M.

So what does this all mean?

My takeaway is that the narrative that 99 out of 100 entrepreneurs are following is flawed. Nearly every entrepreneur I meet asks me how to raise $500k or $1M or $5M for their idea or prototype, expecting to follow the venture path to a $100M or $1B exit. The reality is that those exits are exceedingly rare, and that the path to get there is littered with tens of thousands of startups that at best break even for their investors, leaving the founders with nothing but a story to tell.

Before seeing this new analysis, I have been telling every entrepreneur that I teach to redo their financial plan to launch via friends, family, crowdfunding, and revenues. That advice now has a modicum of proof to back it up. What I see in the analysis is that it is possible to bootstrap a startup all the way to a good exit, and that upon exit the rewards are far greater for the entrepreneur than in the other path.

The story of “owning a smaller percentage of a bigger pie” on average is simply not true.

Lastly, and most importantly, as an entrepreneurial investor, what this analysis tells me is that there is an opportunity awaiting investors who can tap into this other half of successful startups. Using methods like I outline in “Investing without Exits“, there seems to me to be some opportunities for a middle way, to provide capital to speed up and scale up the success of the “Earners”, but without extracting all of the return from the founders.

For a deeper analysis on exits, read Earn versus Burn

If you do a little bit of economic history … you must come to a similar conclusion. Take that rather big innovation of the 19th century … the steam engine and the railroad. A few companies eventually did well, but in the process most all of the start-ups went bankrupt of were bought out.

Peter Burgess … TrueValueMetrics

Multi Dimension Impact Accountanting

Michael, this is very interesting! We are doing a Startup Clean Energy Company and are attempting to build on crowdfunding first > http://igg.me/at/ocean-energy-turbine/x/7953000 Our goal was to grow a little before accepting outside investment although we do have a lot of equity investment offers.

Interesting design. Not one I’ve seen before. Feel free to reach out to me on the lunarmobiscuit.com/contact/ page if you are interested in guidance getting from idea to revenue-generating company. Or simply apply to Fledge at apply.fledge.co