$100,000 in, $300,000 out

The proverbial 10x only applies to the seed and startup stage investors.

It is not uncommon for startups to raise multiple rounds of investments as the company begins earning revenues, enters the growth phase, etc. As the company matures, the risk of failure lessens, and, as the risk lessens, the expected returns by investors lessen, as well.

For an entrepreneur, this means that the price per share rises, and thus, for the same amount of investment, a smaller percentage of the company must be sold. Or, in other words, as the company grows toward success, the cost of capital goes down.

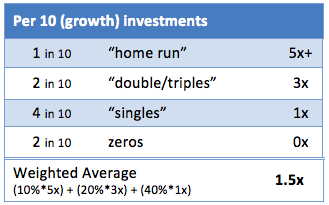

A successful portfolio for an investor focused on the growth stage could look like:

Here, the “home runs” are not 10x, but just 5x. They can be half the returns as above because only the companies that have succeeded at finding customers and earning revenues will be eligible for raising growth capital. Most of the companies from the previous chapter that are failures will have already failed before reaching this stage.

That said, again, few of these investments will turn out to be big hits. In the above portfolio, just one out of ten is a hit at 5x or better, two at 3x, and four in ten return the original capital. The weighted average of those results is 1.5x.

While this looks like a much smaller return than the 2.3x in the seed-stage portfolio described in the previous chapter, do realize that these growth investments make returns much more quickly. They do that because the growth capital comes two to five years after the seed and startup phase capital, so the companies are further along and closer to making profits.

The true return on investment is based on the amount of time it takes to receive the payoff(s), as well as the payoff amount(s). If this growth portfolio takes place three years after the seed portfolio, the shorter timeframe makes the equivalent interest rate (a.k.a. internal rate of return or IRR) close to twenty percent, and thus again a higher rate of return than investing in public companies.

The same logic applies to “mezzanine” investors (mentioned in the chart in Chapter 3), who provide the capital required for a high-growth company, generally on its way to going public (a.k.a. an initial public offering, better known as its acronym, IPO). They too aim to earn twenty percent (or more) in just three to six months.

The longer the startup has been operating and the closer the startup seems toward success, the lower the multiple required by investors to reach a reasonable return on investment.