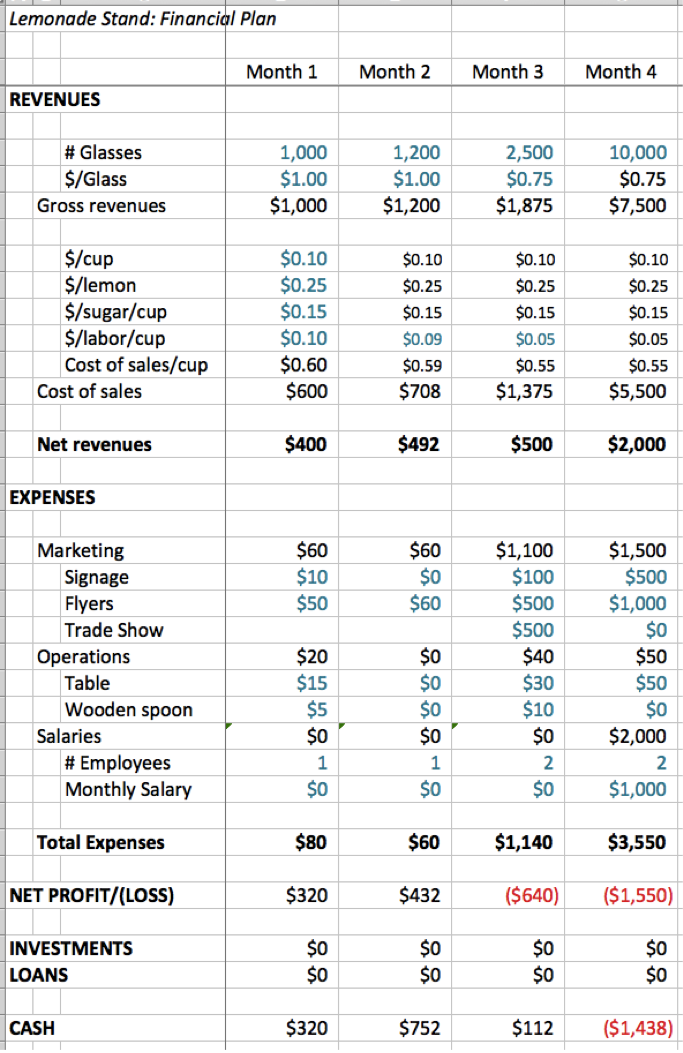

In month four, we do not double sales… We quadruple them.

Again, this is not something that a typical startup would do in one month, but it demonstrates an important aspect of financial planning.

The only change to the revenues is increasing the number of glasses to 10,000. You can easily see that nothing else is changed, as all of the other numbers are black.

10,000 glasses in a month is an average of over 300 glasses of lemonade per day. To reasonably sell and serve that much lemonade will likely require multiple locations. With multiple locations and with a business that is earning $7,500 in top-line revenues, we need to consider having some management in this company.

To model the cost of our employees, a new subsection has been added to the expenses labeled “Salaries.” The simplest way to model the cost of employees is to make assumptions about the number of employees and the average cost per employee. Then multiply those two numbers together to get the total employee expenses.

Your business may need more details than this, especially if you have a mix of full-time and part-time staff or a large staff with varying salaries or any structure more complicated than this chain of lemonade stands. However, no matter how much detail you include, the key number you must compute for employees is how much they cost in cash, which counts as another fixed cost.

What happens to our lemonade business when we quadruple sales, add in the necessary marketing and equipment to make those sales, and start paying employees a salary? We lose money.

At the same time, however, Month 4 is the first month that this business resembles a real business rather than a hobby. If the monthly revenues continued to run like this for a whole year, the business would earn a total of $90,000 in gross revenues. This is called a “run rate,” and our business has a “run rate” of $90,000 ($90,000 = $7,500 x 12). (Note, however, that the net revenue would be only $24,000 ($2,000 x 12), and that still doesn’t account for fixed expenses).

The business also seems more real because it has paid employees. Those salaries, albeit small, are at least some incentive for the workers to sit around all day, mixing and pouring lemonade.

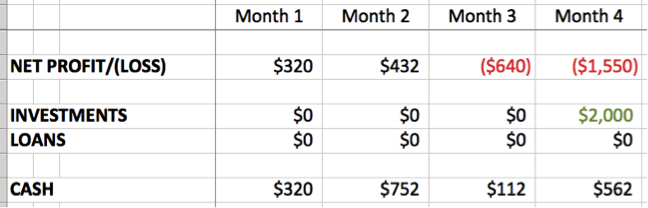

Banks do not allow a business to have a negative balance, and thus we need to do something within the model to make that cash balance positive.

On paper, this fix is simple. We find investors to invest in our company. In reality, this is itself a complex, time-consuming, often difficult process, but that is a lesson for another time. For now, we assume we can find investors whenever the need arises.

To overcome the negative cash balance of $1,438, we need to raise at least $1,500 from investors. To add a bit of “cushion,” in case the reality of running the business does not match the plan, I’ve rounded this up to $2,000.

This $2,000 goes in the line labeled “Investments,” and, with that, the month ends with a positive cash balance. (Remember that the cash balance includes the net loss plus the investments and loans.)

In addition, recall in Month 1 how the cash at the end of the month did not account for the $560 in startup costs? Similarly, it is unclear when, during Month 4, the $2,000 must arrive so there is enough cash to operate the company. If it arrives on Day 1 of Month 4, all will be well, but Day 30 is likely too late.

When implementing a financial plan, (i.e., when you are actually operating your business), it is far better to get the investments a month or two or three before the funds are needed, rather than in the month the financial plan calls for them.

Run out of cash, and your company dies.