The Next Step is a series of books, online lectures, and podcasts for entrepreneurs to help guide them in the complex process from an idea, to a viable business plan, to a successful operating company, including an investment along the way, if needed.

One Big Book

Nine out of every ten startups will fail. Want to avoid their mistakes and become part of the 10% that succeed? The Next Step is the first series to take entrepreneurs step-by-step through the process from raw idea to operational startup.

Each step includes a set of key questions and practices designed to help you build a business plan and pitches for potential investors and customers. This was originally published in six separate books, which in the 10th Anniversary Edition are combined into one big hardcover or paperback book, with updated content in nearly every chapter, and a handful of bonus chapters that were not part of the original books.

The topics include business planning, planning your marketing and sales efforts, creating a financial model, crafting a great pitch, raising capital, and splitting the pie with your team. Whether you’re a seasoned professional looking to make a change, a new college graduate with a big idea, or a small business owner in need of more structure, this must-read series from 25-year, serial entrepreneur Luni Libes, will help you turn your idea into reality.

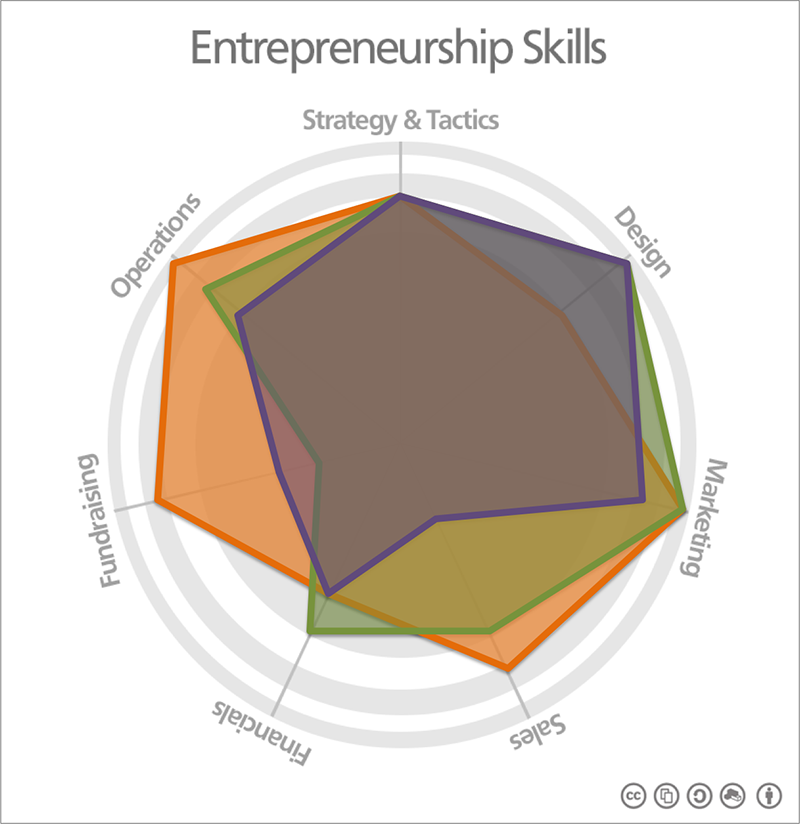

Skills Map

Before you read any of the books, watch any of the videos, or listen to any of the podcasts, start with a self assessment of your entrepreneurship skills.

The challenge to you is to fill in the gaps in your knowledge, as you’ll need all of these skills in order to succeed as an entrepreneur. Not as expert in everything, but enough to know if the people you hire to fill in your gaps are doing their jobs correctly.

Online (Free) Books

If you are starting a company on a budget, the original books are all now readable online, for free. Just click on any of the book titles below to read the books chapter by chapter:

Book 1 – Guiding you from idea to startup

Start here. This book has two parts. The first part covers the process from having an idea through building a viable business plan, with a few tips beyond that in raising capital and operating the business. What you’ll learn in that process is that all plans are wrong, and the second part of the book helps you find your Plan B, Plan C, and Plan D, because you’ll very likely need them.

Book 2 – Sales & Marketing

This book has two parts too, Marketing first and Sales second (which is logically the better order). There are thousands of books on these two topics so this book instead focuses on what you need to worry about as a startup. Specifically what you need to create a marketing plan and sales plan when you start a new company.

Book 3 – Financial Plan

For most entrepreneurs, this is the most painful part of building a business plan. it is also, by far, the most useful. You can save yourself dozens of sleepless nights and years of struggle by taking a few hours and working out the answers to the key questions:

Can this business make money?

If so, enough to merit the time and energy?

If so, what is needed to reach success?

Book 4 – Pitching

Without a great pitch, you’ll have a difficult time recruiting a team, closing customers, and raising capital. This book takes you step by step through the process of creating that pitch.

See Creating a simple, compelling pitch deck for an example pitch deck, and slide-by-slide commentary on making it better.

Book 5 – Fundraising

You are not going to like the Realities of Funding a Startup, but they are nonetheless the true story of raising capital for a startup. When I teach this in person, I warn the audience they’ll be depressed by the end, if not sooner.

Book 6 – Dividing Equity

Most co-founders end up splitting the initial pie 50:50 or 33:33:33. That is rarely the right answer. Most first time entrepreneurs overvalue the startup phase, shooting themselves in the foot while still inches from the starting line. And few first time entrepreneurs know about restricted shares, and many will suffer from that lack of knowledge. Read this short book to fill in all those gaps of knowledge and more.

Online Video Lectures

I taught my MBA class about a dozen times and I taught the same class to thousands of entrepreneurs at my accelerator. Rather than lecturing each and every time, I recorded those lectures as videos, and thus if you prefer video to reading, or want two views of the same material, The Next Step: Online Classroom covers most of the content from the books.

Note the videos and books are linked together. See the bottom of the video pages and chapter pages to jump between the two media.

Podcast

If you prefer listening to reading or videos, much of the same lessons as the books are taught in a short-form podcast. Visit the podcast page to listen here or download The Next Step from the Apple or Google podcast app.

One more thing…

It seems crazy and presumptuous to say that the multi-hundred billion dollar startup investing industry does business all wrong, but it is nonetheless true. Not that the idea of investing is startups is crazy, as history has clearly shown there is value in that effort for both entrepreneurs and investors. Rather, it is crazy in the manner of the emperor parading around town wearing an invisible suit, with his nobles and all the press touting how wonderful and splendid his clothing.

If you are an Angel investor or operating a small venture capital fund, you are likely blindly following the models set by the emperors. Meanwhile, you don’t notice that it is you and not them who are naked. The Next Step for Investors: Revenue-based investing explains an alternative style of investing, one that doesn’t need the exceedingly rare 10x return to make money for investors, introducing a set of structures for investing in revenues rather than exits. Structures that span debt, equity, and forms in-between. Structures that benefit both entrepreneurs and investors alike. Structures that don’t follow the historic norms, but which work for entrepreneurs and investors alike.