At a recent Seattle Impact Investing Group meeting, Leslie Christian was a guest speaker, sharing some of her wisdom on mixing impact with investing. Her wisdom is wide and deep, but one idea especially popped out: the paradigm of shareholder value, especially in regard to investors, risk, and return.

Specifically, what we’re taught in Finance is the following equation:

Revenues – Expenses = Profit

And we’re taught that it’s the job of management to maximize revenues while minimizing expenses, thereby creating ever-growing profits. Those profits being the “shareholder value” that supposedly belongs to the capitalists.

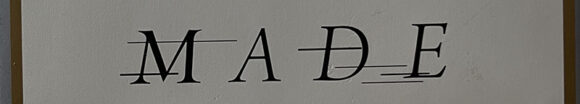

I have written previously about the fallacy that business exists solely to maximize returns for investors. Leslie not only agreed, but she offered a new formula to help make this much more obvious:

Revenues – Expenses = 0

Where the cost of capital and retained earnings are just more expenses. She’s not proposing that companies aim to not be profitable. What she’s really saying is that management should take a step back and consider that investors are one of many stakeholders who should benefit from the value generated by the business.

Dropping out of the hypothetical, imagine you are running a company with revenues of $1 million per month. Most of those revenues are going to get spent running the business. How do you split the $1 million across:

- Cost of Goods (vendors)

- Salaries / Wages

- Benefits

- Rent

- Utilities

- Interest (debt)

- Dividends/Buy-backs (equity)

- Equipment (capital)

- Etc.

In the current paradigm, management aims to minimize categories 1-5, and keep borrowing to a level where interest (item 6) is affordable. Then from what is “left over”, buy more equipment as needed and affordable to scale up the business (item 7) and then call whatever is left “profits.”

Leslie is suggesting that the budget aim that items 1-9 equal total revenues, and that rather than considering that any of the capital is “left over”, to instead put some thought into the best allocation for all these categories. That is a subtle shift from today’s paradigm, but the result of that shift can make a huge difference in income and wealth inequality.

Here in Seattle in 2018, we are home to the world’s newest richest man, Jeff Bezos, whose company employs hundreds of thousands of workers, many who must rely on Food Stamps to supplement their income. Amazon prides itself on minimizing its operational costs, and as a result the “left over” value generated by their business goes to Jeff Bezos and the shareholders of Amazon. This despite the fact that those shareholders have been well compensated for the risk they took.

Amazon only ever raised about $100 million from investors, and its total market value recently surpassed $1 trillion. That is a 1,000x return on investment. Most early-stage investors are happy with a 10x return, and giddy with a 20x return.

Amazon provides a highly useful service to its customers. If only it (and nearly every other public company) would also provide an equally useful service to its employees, we’d not be talking about income and wealth inequality in America. And all it would take to change that outcome is looking at investor returns as an expense instead of the “left over” rewards of doing business.