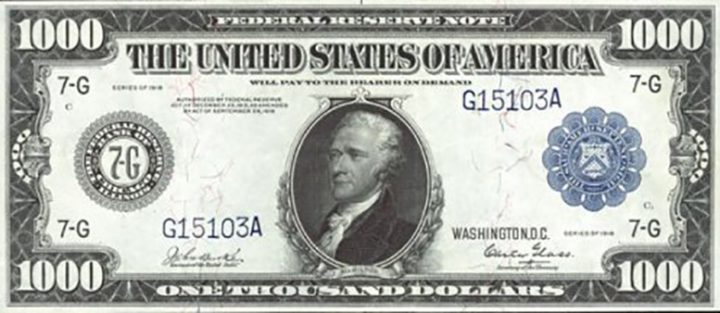

Americans today think of “money” as paper that in minted by governments, but this was not always the case. A century ago money (“notes”) still retained their ancient connection to credit. Notes were promises to be redeemed for coin or reliable securities. — America’s Bank (page 200).

Today we’ve not lost this underlying concept of credit, but we instead ignore many of the layers of credit that exist in this amorphous, complex concept we call “money” as when all is going well, they are ignorable.

For most of my life I wondered what the difference was between a dollar in a bank account and a dollar in my pocket. They seemed different but how? I finally found that answer in a class on Coursera, the Economics of Money & Banking. (If you like my posts on economics and money, I highly recommend it. If you skip these posts, then you won’t see this recommendation).

The answer is that there is a hierarchy of money.

At the top of the hierarchy used to be gold. For some people “real” money still is gold. For most of us, that reality ended well before we were born, and instead the top of the hierarchy is the $100 U.S. dollar bill, tinged blue with the security strip. It’s in the place where gold used to be as that $100 bill is accepted just about everyone on the planet.

In the U.S. any $1, $5, $10, $20, $50, or $100 is as good as that $100 bill, just as in Europe any Euro bill (or coin), or Renminbi in China, or Rupee in India (when they are not demonetizing their own currency).

Next down the hierarchy are bank deposits. You can walk into your bank, hand them paper bills, and they’ll add them to your bank balance. You can walk into the bank another day (or to an ATM), and they’ll give you back paper bills. But you already knew that, and you probably just think of those deposits as “money” and probably have more money in the bank than in your wallet or under your mattress.

When all is well, those two forms of money are nearly identical. In banking jargon, we say that they trade “at par”. All that means is that $1 of deposits is worth $1 of paper money. In Africa, both at a bank and for mobile money, you’ll likely have to pay a fee to make that trade, and in the U.S. you may pay a fee at the ATM, so the two forms of money don’t quite always trade at par.

The reality of bank deposits not being money only shows up during a panic. A few years back the people of Greece experienced this reality. They were limited to only withdrawing €20 per day from their bank accounts. The trade was at a par, but the amount of trading was limited. A few years before that, the government of Cyprus seized a portion of everyone’s bank account balances. And back in the Great Depression, there were weeks of “bank holidays” where the banks were all closed.

Meanwhile, the economy has more good days than bad, and thus we treat bank deposits as money. So much so that we accept our salaries as bank deposits (checks are just portable bank deposits if you don’t have direct deposit) and you pay all your bills using bank deposits (check, BillPay, auto-pay are all just transfers of bank deposits, with no cash being moved from bank to bank).

One step further down the hierarchy, we get to loans. If you took out a loan from a bank, notice that they didn’t hand you any cash, they simply increased the balance in your account. Notice too that you repaid them using bank deposits.

Loans are just promises to pay deposits. Deposits are just promised to pay cash.

Do you own a money market fund? Shares in a money market are promises toward a basket of loans. Promises to share the interest of those loans, which promise to pay deposits, which are promises to pay cash.

The hierarchy of promises continues down even more levels of esoteric derivatives, but the point to realize is that money is just a hierarchy of promises all the way down.

Popping back to the title of the post, what has changed in the last 100 years is that the top of the hierarchy is no longer gold and that 100 years of trust in a stable system of banking means that in our daily lives bank deposits are as good as cash.

Looking 100 years into the future, this will very likely change again, with non-bank balances being trusted too. Maybe that will be your mobile crypto wallet. Maybe it’ll be a chip embedded behind your ear. Or maybe it’ll still be a plastic card you keep in your wallet that looks greenish blue and has a picture of a dead person on the front. Either way as long as people trust it to have value, it’ll have value as money is really nothing more than trust.