First time entrepreneurs are often the CEO of a corporation, but nonetheless don’t know exactly what a corporation actually is, nor how a corporation works with employees, management, directors, and investors.

This series of posts will walk through those details. Not as a lawyer, as I am neither a lawyer nor have ever taken a class at a law school (not counting the one I guest lecture I taught). This information is provided as a fellow entrepreneur, a fellow CEO, and as someone who has incorporated and ran over a dozen corporations of varies forms over the last 30+ years.

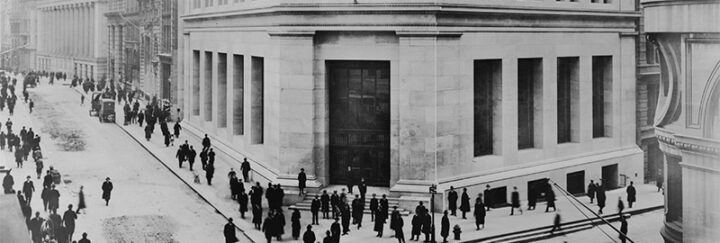

A little history

I taught MBA candidates for nearly a decade, and from that work I tend to start all my lessons back in time, as I find it helps to understand why the world works the way it works if you first understand how the workings came about.

Corporations in the form recognizable today do not date back into ancient times. The first modern-style corporations came about in the first few years of the 1600s in England and Holland. In both cases, the problem at hand was how to fund trading (and pillaging) expeditions far overseas, off into the recently “discovered” parts of the Far East and New World. Such expeditions were both expensive and highly risky, too expensive and too risky for any one rich monarch or noble to fund alone.

The answer was the public corporation, chartered by the King and split into shares that were available for anyone (rich enough) to purchase. But that invention of corporate shares was not the key innovation to make this work. No, the key innovation was the idea of “limited liability“.

Limited Liability

What makes corporations work is limited liability, i.e. the legal “wall” that protects investors from losing more than invested. This is, in reality, two separate protections wrapped in one.

First, when an investor buys a share in a company (“corporation” and “company” are synonyms and I’ll use whichever flows in the sentence), they risk losing that money, but unlike in a partnership, they can’t lose any of their other wealth. In practice what this means is that anyone suing the company can win the assets (a.k.a. property) of the company, but they can’t then breach past the “corporate wall” to win any other assets of the owners. That holds true as long as the investors are “passive” investors, not part of management. That invisible corporate wall goes away if management breaks the law, e.g. commits fraud, but as long as they make reasonable business decisions, then that corporate wall protects management too.

Second, the investors are not held at fault if the management or employees of the company break the law. This isn’t true in partnership. If one partner commits fraud, all the partners are at fault. This second power was very important back in the days of colonization, as it meant the investors back home were not liable for any pillaging or pirating that the crew of the ship might have done in their journey. Without this protection, a lot fewer investors would take the risk investing in such journeys.

Aside: The Colonies were Corporations

What gets overlooked by the history books was that the colonies of England, Netherlands, and many other European powers were profit-seeking corporations. The Pilgrims who celebrated that first American Thanksgiving were shareholders of the Virginia Corporation, which was chartered by the King of England not to settle in America but to export lumber, firs, and fish for a profit of the Virginia Company investors. They did manage to ship some goods back, but they never did earn a profit.

Similarly, what is now Canada was first explored by the Hudson Bay Company, another English for-profit company. India was not invaded by the English navy, it was taken over by the British East India Company, and only after that succeeded handed over to the government to operate as a colony.

And it wasn’t just the English. The Dutch East India Company was, in the 1600s, by far the biggest, richest, and one of the most successful corporations of all time, until the British East India Company managed to take over most of its trading posts and most of its colonies in the 1700s.

Your Corporation

Back to the 21st Century, if they speak English in your country then the law that underlies your corporation dates back to the 1600s. The British left “Common Law” throughout their empire, and within that base set of laws are the rules for “incorporation”.

The biggest change to those rules came in the 1800s, when the Kings and legislatures handed the power to grant corporations to the bureaucrats, avoiding the need to lobby for a law to get a company incorporated. In Rwanda, you can “spin up” a corporation online, in minutes. In the U.S. it can be done in a few hours. Elsewhere it might still take a month, but the process is now just paperwork.

A second big change also came in the 1800s when some U.S. States (all corporate law in the U.S. is at the State level, not the Federal level) allowed corporations to be perpetual. Prior to that the corporate charters had expiration dates, requiring renewals by the King or legislature or bureaucrats.

The third big change came in the late 1800s and early 1900s, when again some U.S. States led the way, allowing corporations to own other corporations. That begat the holding company and eventually the investment fund.

The most recent change came in the early 21st Century with the creation of the Public Benefit Corporation (or Social Purpose Corporation), which leads to the story of how the Bolskevik Revolution in Russia caused Income Inequality, which is a bit irrelevant to this primer.