Venture capital funds often tout cash-on-cash returns of 2x-3x over 10 years. That is the supposed “norm” for successful funds. But despite the industry being tracked investment by investment in detail, the industry as a whole is notoriously opaque when it comes to the returns of the funds.

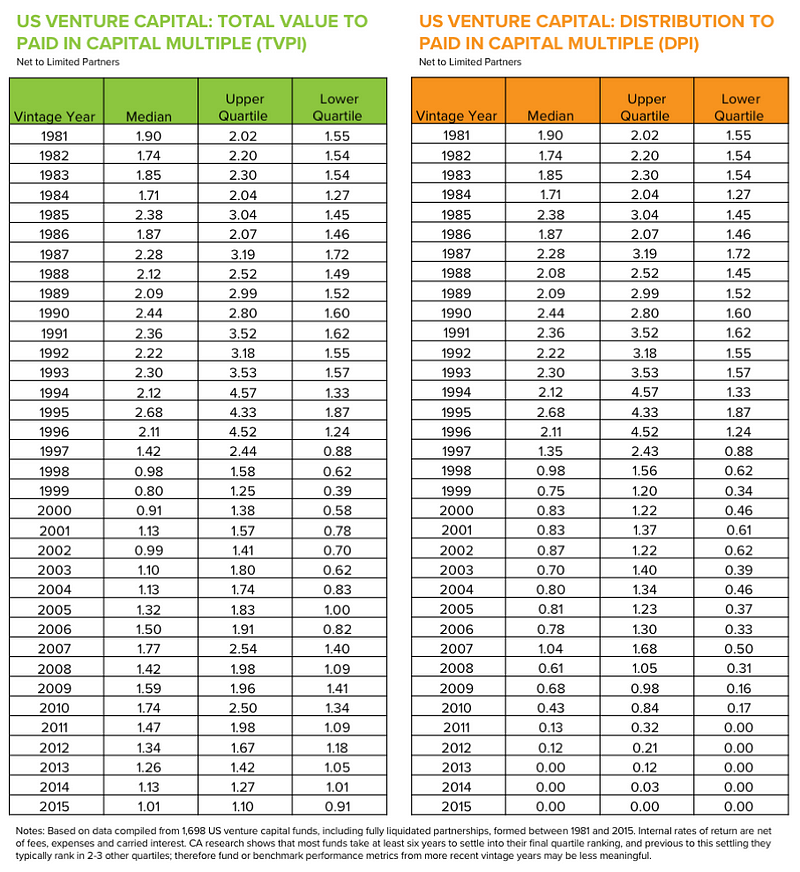

Thank you to Dan Gray (@credistick) who tweeted the following table, with data from 1981 through 2015 collected and published by Cambridge Associates.

Turns out the reality was 2x-3x, for funds launched in the 1980s and 1990s, with 3x-5x distributions during the dot-com bubble. But here in the 2000s valuations have risen and with that, the value of the venture funds and the distributions back to investors is way down, with even the top 25% of funds (on average) failing to 2x capital.

What this table doesn’t tell us is whether the funds from the 2010s are still at this low level or whether the industry as a whole is heading upward. Funds from 2000-2010 had to survive the dot-com crash and thus it is not surprising they did poorly. Funds launched after 2006 didn’t have 10 full years to play out before this data ends, which is why distributions are so low in the last seven rows. Plus don’t forget there was a Great Recession in 2007-2009 too that these funds had to survive.

All those issues notwithstanding, it’s safe to say VC returns in the 21st Century are likely not the 2x-3x of the “good old days” beyond the few funds that hit a giant winner.