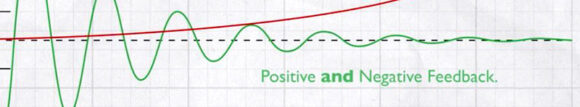

A common problem early in the startup process, in the market research phase, is too much positive feedback. Positive feedback feels great. Positive feedback is confirmation that your product or plan will work. Everyone loves hearing positive feedback and no one get mad at you for giving positive feedback. Trouble is, Plan A rarely works and you need the negative feedback to fix those flaws. I was...