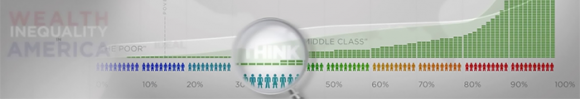

It’s way worse than you think and way way worse than you want it to be.

What sets Apple, Martin Luther King, and the Wright Brothers apart?

Simon Sinek explains the answer, using one simple diagram, one key word, and from biology. And this theory matches why mission-driven companies find so much more interest than yet-another tech company. It’s all about the Why.

startwithwhy.com

Five years ago, while still working on the business plan that was to become Fledge, I helped run a weekend event for “social entrepreneurs” called #SocEnt Weekend. From that came the following video with Brian Howe, co-founder of what was to become Impact Hub Seattle. Reminiscing is often fun. More so when we can look back five years to see what we thought might happen in ten years...

Philanthropy does an amazing amount of good in the world. However, when philanthropy finds a solution to a problem, the solution only scales through yet-more philanthropy. In contrast, when a for-profit company finds a solution, the profits from the solution pay for more. In a world where 7 billion people have access to a Coke within a half day’s walk, the same should be true for clean...

It is reasonably easy to measure the impact of any one impact investment. But as soon as you have two impacts in two different sectors, adding them together into a single value becomes a challenge. Or was… until the invention of the Pinchot Impact Index. This index provides that elusive single value, trackable over time just like the financial bottom line. This webinar explains the pros...

Impact investors face a startup market that has few acquisitions, fewer IPOs, and is filled with entrepreneurs who liken selling their companies to selling out. How can investors earn a reasonable/market-rate return given these realities? This webinar will share a series of alternative investment structures used to create a return on investment without a traditional exit. More webinars at fledge...

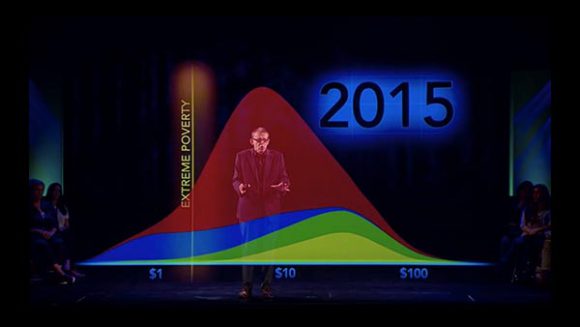

Hans Rosling has a great new talk on global poverty (with even better graphics than his first TED talks). As always, he tells a great story. However, in his five minutes he explains what happened over 215 years, but doesn’t provide any analysis. Most importantly, he doesn’t point out that we are not only winning this war on global poverty, but at the same time losing. The story...

The Social Entrepreneur podcast is for aspiring and early-stage social entrepreneurs; and for those who want to make an impact on the world. Stories about the grand challenges in the world and the solutions that they are creating. Listen to the interview on Stitcher or Soundcloud or download it on iTunes. Links to the talks and companies mentioned in the interview: 1st Fledge Demo Day, 50 years...

The last time I presented at an event for investors, the first five people all asked me the same question, “Any exits yet?” The more years I spend focusing on revenue-based investing, the more that question is getting on my nerves. Perhaps some of that is on me, as the talks I give are generally titled “Investing without Exits” or “Alternative Exits” or...