Venture capital should never have become the standard way for us to fund new businesses. As an asset class, it’s uniquely designed to fund disruptive innovations. It does this by funding ventures that are likely to fail, but — if successful — can result in outsized outcomes. In other words, it’s a ‘home run’ based model. For a venture capitalist, seeing 6 or 7 out of 10 portfolio companies fail is part of the playbook. In fact, if VC’s aren’t seeing enough failures in their portfolio, they take it as a sign that they may not be taking enough risk (as Babe Ruth once said: “every strike brings me closer to my next home run”). Good VC’s understand they aren’t looking for a ‘normal distribution’ of outcomes in their portfolio — they’re looking for the “fund maker”. Or in other words, the unicorn.

But does that kind of failure rate represent a good deal for (most) founders? How about for society as a whole?

By looking at the world through a venture capital lens, we do three things that are often bad for founders, workers, communities and the planet:

- we overlook companies that could become good, sustainable businesses, but aren’t likely to generate the outsized returns the venture funds are seeking

- we make companies more likely to fail by pushing them to take on excessive risk in pursuit of a moonshot

- we push companies to ‘exit’, whether or not it allows them to stick to their founding vision and mission

In fact, it’s debatable whether VC is a great model for investors themselves. In general, only the elite ‘top quartile’ venture funds have generated what is often referred to as “venture returns” for their investors (the LPs). Unicorn hunting is a tough business!

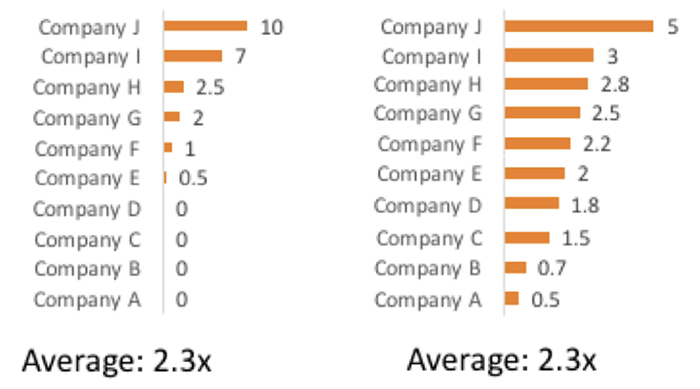

Read the rest of this essay by Aner Ben-Ami on Noteworthy, including an explanation of this great diagram: