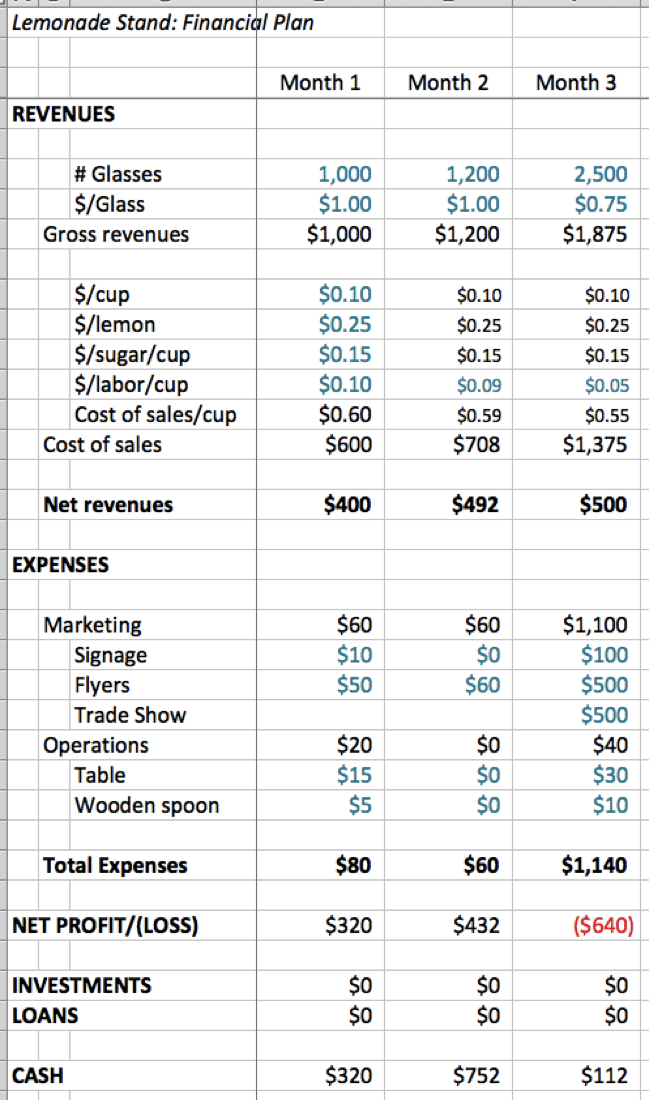

With two months of profitable operations in hand, it is time to scale up this business.

For most businesses, it takes quite a lot longer than two months before the business is profitable or ready to be doubled in size. However, I am trying to demonstrate the common features of financial planning, thus, for Month 3, I have created the unrealistic scenario where sales more than double.

To grow sales to 2,500 glasses of lemonade, we lower the price to $0.75 per glass. We assume we can double sales without adding any staff, and thus the labor cost per glass drops in half, to $0.05 per glass.

We do assume that doubling sales will require a lot more marketing, including a professionally printed sign and professionally printed flyers. And to ensure those glasses are processed quickly, we buy a second table and a second spoon.

With the drop in price, our net revenues still grow, but only by $8 more than the previous month, to $500. With the added expenses, for the first time, our expenses exceed our revenues, and we have a loss.

Given the loss, why might this be a reasonable choice?

First and foremost, we are trying here to create a viable business. Profits are nice, but $752 in profits after two months of effort is not enough to support an American family.

Secondly, part of the losses this month were due to the $100 sign. That sign gets reused next month and every month for a few years. Thus, it is an investment. The same is true of the second table and spoon. (The accountants at this point can start complaining about capital expenses versus operational expenses and the lack of amortization, but ignore them. We are entrepreneurs, and we are modeling a business. We care only about cash.)

The other lesson to learn from this month’s results is that, as a business, despite the loss, we still have cash in the bank. We lost $620 of our $752, leaving us with $112.

Or, in other words, we could afford to make these investments and afford these losses. In contrast, a negative number under cash would mean that we could not afford the investments. Once you run out of cash, you can’t run your business anymore, even if you have a great product and happy customers, because you cannot afford to get the product to them. Always keep your eye on your cash!

And a reminder: this is our first pass through the plan, not the last word in how we think this business should be run.