$100,000 in, $1,000,000 out

Both Angels and venture capitalists invest in early-stage startups expecting a 10x return from each of their investments. Why 10x? This is due to another reality: that most startups fail; that most startups do not increase their value at all, despite the funding.

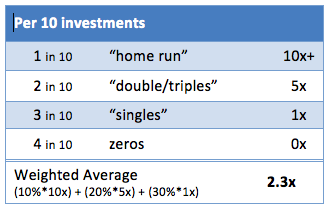

VCs and Angels understand that not every company they invest in will succeed. For the early-stage investment model to succeed, only one out of every ten investments needs to return 10x or more. The returns from a successful VC fund or Angel portfolio typically resemble the following:

(Thank you Geoff Entress, Seattle super-Angel and Venture Partner for this break down)

For every ten investments, one is at least a 10x return, with the earliest investors in companies such as Apple, Google, and Facebook earning 30x or 50x or even 100x. Two of every ten investments is profitable, but not nearly as much as the home runs. Three of ten simply return the investment capital, sometimes a bit less and occasionally a bit more. Four of ten are complete losses, returning nothing at all.

The weighted average of such a portfolio is 2x-3x, depending on the specific sizes of the returns. In the model portfolio above, the return is 2.3x; i.e., $1 million in total investments would return $2.3 million in cash. A $100 million fund with the same return on investment would return $230 million in cash.

This is the “cash on cash” return. Do note that, typically, an active Angel investor or VC would take three to five years to make ten investments, and then these returns would arrive across the next five to ten years. Thus, the equivalent interest rate (a.k.a. internal rate of return or IRR) of this return depends on the actual length of time between the investment and return of capital. For VCs, the expected IRR by their investors is around twenty percent, plus or minus a few percent.

From the perspective of the venture capitalists and their investors, earning a 2.3x return in ten years is good. For an Angel, this level of return is a success, no matter how long it takes. But do note that, from the perspective of the entrepreneurs and startups, only three of every ten of the above investments succeed. Seven out of ten are failures. This despite every entrepreneur believing they have the best idea and a great team. And this despite the VCs and Angels believing those entrepreneurs are correct.

The “proverbial” 10x comes from this intersection of failure and return on investment. If investing in startups returned no more than investing in Treasury bonds, all intelligent investors would keep their money in bonds, as they carry far lower risk than startups. The same logic is true for investing in public shares (i.e., companies listed on a stock exchange) versus startups. Public companies are far less risky than startups.

If startups failed less often, the 10x multiple would be lower. Or if investments in startups were not so reliant on acquisitions, that multiple could be lower.

However, today, most startup investments fail, and the vast majority of startup investments take a form that results in a 10x return to make these investments worth the effort of the investors. Thus, do not jump to the hasty conclusion that Angels and VCs are greedy. They are instead being rational and competitive, given their needs and yours.