Companies do not own themselves

All sophisticated investors will want to understand how you have legally structured your company and, in that part of the due diligence process, will ask you for your cap table.

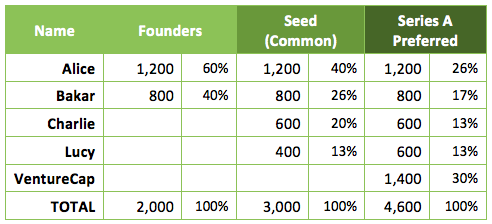

A cap table is nothing more than a table listing the owners of your company, how many shares each owner owns, and what type of shares they own.

Above is an example cap table. Alice and Bakar are the co-founders. For whatever reason (cap tables do not typically provide reasons, just numbers), they’ve agreed to split the ownership of the company 60:40 to Alice. They then sold a third of their company to two Angels, Charlie and Lucy. Finally, in a separate round, they sold thirty percent of the company to VentureCap, a venture capital company.

Each round of investment is listed in (at least) a pair of columns, one that states the specific number of shares, and another that computes the percentage ownership.

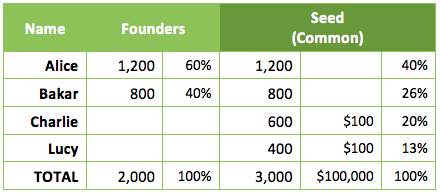

Some cap tables can include more detail, such as the price paid per share and, at the bottom, the total amount raised per round. Below is an example of this for the same company as above, with a $100,000 seed round. No price is listed for the Founders’ round, as those shares were not purchased for cash but allocated as part of founding the company.

At first glance, a cap table can look confusing, but if you focus on just one set of columns at a time, it is rather simple. The purpose of a cap table is to convey who owns or owned the company at any given moment in time. Since ownership only changes when equity is sold to investors, the changes in ownership are whenever there is a new round of equity.

In each round, the total ownership must always equal 100%. The specific number of shares allocated to the founders is arbitrary. I’ve seen everything from a total of ten shares to ten million shares allocated to the founders. For my own startups, my lawyers picked a number so that the first investors paid between $0.10 and $1.00 per share. That makes numbers of shares of dollars easily convertible in everyone’s head, simplifying life for everyone involved.

Dilution

As equity is sold, existing owners are diluted. In the first example above, Alice’s ownership percentage drops from sixty percent to forty percent in the seed round, then down to twenty-six percent after the Series A round. Why would she do this? First and foremost, because she believed her company needed the money from Charlie and Lucy, and then more money from VentureCap. The cap table is where the cost of equity becomes visible. Secondly, she justified the dilution because, presumably, the value of the company increased with the use of those funds, and, with that, her share of the total value increased in each round.

Finally, note that while founders are typically diluted in each round, investors often join in subsequent rounds, keeping their pro rata share of the company (i.e., to hold steady their percentage ownership). In the above example, Lucy purchased 200 shares in the Series A, keeping her thirteen percent ownership unchanged.

That may seem a bit counterintuitive at first. Why would an investor provide more money but receive no larger ownership percentage in return? As the value of the company rises, the value of each share rises. Thirteen percent of a company worth $100,000 is $13,000. Thirteen percent of the same company now worth $10 million is $1.3 million.

Remember, investors are investing to earn money, and they can do that not only by investing in new companies but also by investing in subsequent rounds of companies they already own. In terms of risks, they know far more about the companies they already own than those they don’t, and thus follow-on investments are often better choices than new investments.

In reality, sophisticated Angel investors and venture capitalists usually expect to make multiple investments in each of their companies. When they ask to see your cap table, they not only want to see who owns your company, but they also want to know if your existing investors are likely to join in each and every subsequent round of investment. Having your existing investors join in new investment rounds is a positive sign to new investors, a sign that your management team is meeting its milestones, and thus a sign of a company that is doing well.