I’m often asked what I do. I invest in young companies and help them scale up. That is true but a bit vague. So today let me show you what I mean by scale up, using seven examples from my Africa Eats portfolio. Africa Eats invests in companies building the food/ag supply chain, filling in the gaps of business infrastructure, and our progress ending hunger and poverty.

I met all of the following entrepreneurs through various Fledge accelerators:

I met Goldenpot at the end of 2019. The company was two years old. $24,000 in annual revenues. Working with 250 smallholder women farmers outside Arusha, Tanzania. Giving the farmers free seeds and inputs, aggregating the maize, and grinding it into maize flour. Four years later, the company still makes maize flour, but now also makes instant porridge and breakfast cereal, growing in 2023 past $1 million in annual revenues. Fledge invested $20,000 in 2020 and Africa Eats has invested $200,00.

I met Ziweto Enterprise in 2016. Back then the company was three small agrovet shops in rural Malawi, each shop earning just $10,000 per year. By 2019 the company was the largest supplier of agrovet supplies in Malawi, selling vaccines, medicines, and other veterinarian supplies to other agrovet shops as well as operating 10 of their own stores. In 2022 the company built an animal feed factory. That year would have seen revenues over $1 million USD except for the 25% devaluation of the Malawi kwacha. Revenues will be over $1 million in 2023.

Fledge invested $20,000 in 2016. Fledge invested $75,000 in 2017 to buy its main distributor. Hivos joined as a co-investor in 2019. The Malawi Challenge Fund provided the capital for the animal feed manufacturing line.

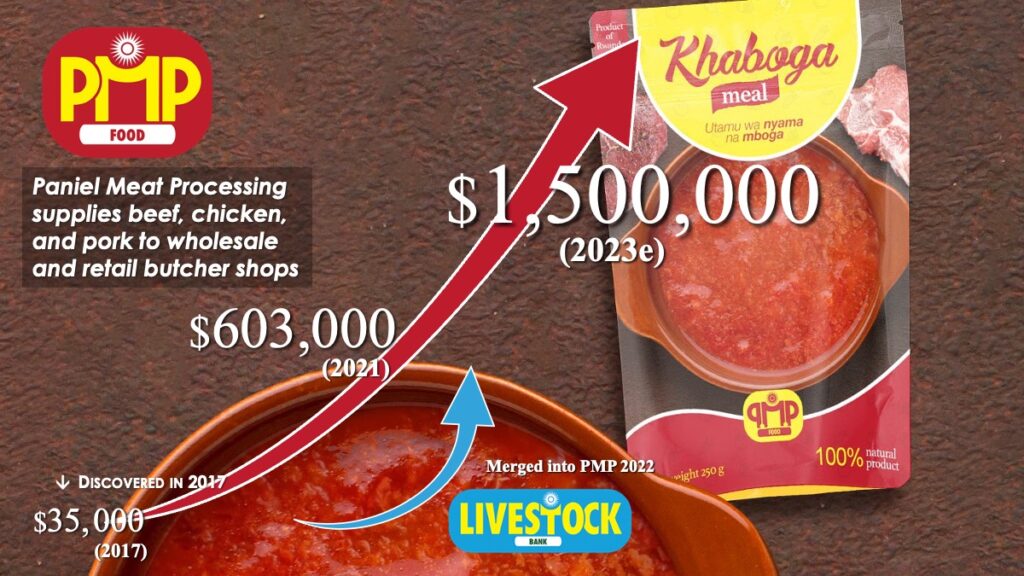

I found Paniel Meat Processing in 2016, but the U.S. refused to give the founder a visa, so I didn’t get to meet the founder and company until 2017. Its equipment then was just one hand-powered meat grinder and one hand-powered sausage stuffing machine. It was back then the fourth largest meat processing company in Rwanda, and six years later is still ranked fourth, but has grown to over $1.5 million in annual revenues. Along the way the founder created Livestock Bank to distribute animal husbandry to thousands of Rwandan smallholder farmers and merged that business into PMP in 2022.

PMP attended Fledge Peru, receiving an investment of just $15,000 in 2017. $162,000 has been invited by Africa Eats in a few other investments in 2020, 2021, and 2022.

I met Swahili Honey in the middle of 2018, one of the thousands of honey aggregators in Africa working with smallholder farmers. Five year later, few have grown as fast as this company. 10x in 5 years. On track to be the largest honey company in Tanzania. Well over $2 million in annual revenues. Exporting honey and beeswax around the world.

Swahili Honey attended The Nature-Accelerator at the University of Padova in Italy. One of three African companies invited into that EU-funded, Fledge-partner program. The company received a €20,000 investment (worth $17,580 USD at the time). Africa Eats invested another $287,000 in a half dozen small investments since 2020 and University Impact lent the company $200,000.

I met Agro Supply at the end of 2019, the end of its third year of operations. We were excited to see how their unique lay-a-way sales model worked and whether it would scale. 30x growth in four years. Over $3 million in annual revenues from just 30,000 smallholder farmers, with millions of similar farmers in Uganda yet to know about the company.

Fledge invested $20,000 in 2020 and Agro Supply received the first-ever investment from Africa Eats later that year of $50,000. Africa Eats has invested $600,000 in total since 2020, but more of that is debt than equity and due to be repaid soon.

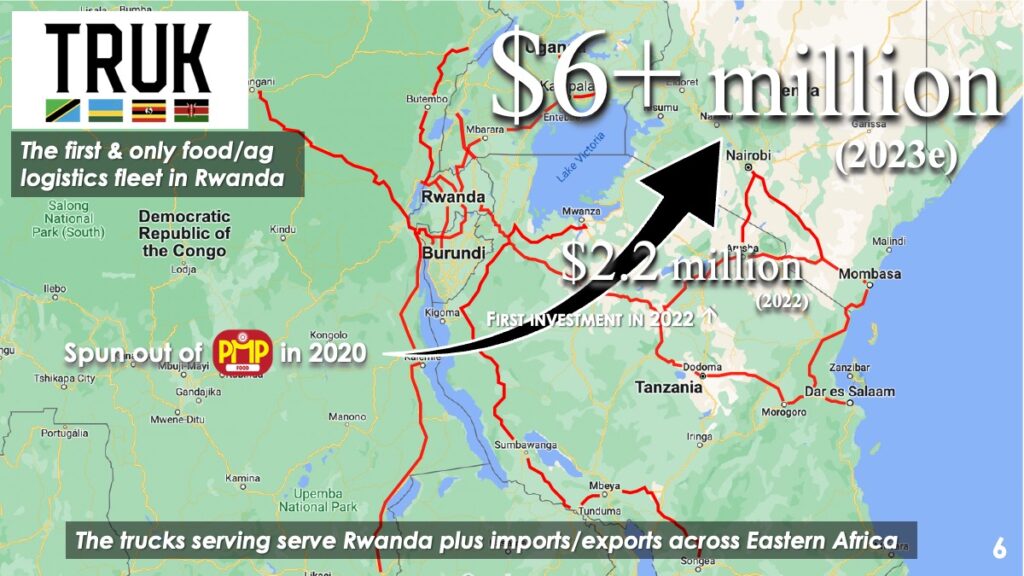

The founder of PMP (see above) saw an opportunity during the pandemic lockdowns of 2020, spinning up/out a food/ag refrigerated logistics company, TRUK. He bootstrapped it for the first two years before asking for any investment capital. Africa Eats invested just $200,000 at the start of 2022 and the revenues that year grew 4x to $2.2 million. A year later, revenues have grown almost 3x Y/Y, past $6 million.

We count the founders as the alumni of Fledge, not the companies. This company was created by the same founder as PMP (and Livestock Bank). That first investment in February 2020 was $200,000. Another $400,000 was provided at the end of 2020, split 60:40 debt:equity. In mid-2023, another $350,000 of debt was provided. So $950,000 in total, used to create $6+ million in revenues and more than $1.5 million in profits.

The oldest of these companies is East Africa Foods, which I met in 2014 after their first year of business. $100,000 of annual revenues that year. Ten years later, in 2022, over $10 million. Growing 50% Y/Y in 2023, surpassing $15 million. 150x growth since we met them. All of these revenues from the outputs of over 10,000 smallholder farmers in Tanzania. Most of this from potatoes, onions, and bananas, plus a little from rice, beans, mangoes, and various other crops.

Fledge in 2014 wrote smaller investment checks, just $15,000. Fledge in 2014 had no follow-on investment funds, so a handful of Fledge investors pooled $50,000 into a loan to the company. That loan was repaid before the company surpassed $1 million in annual revenues, and no new equity investors joined before then. Since then the company has raised millions in both debt and equity from a long list of impact investment funds. AgDevCo, Acumen Resilient Ag Fund, FINCA, Goodwell, MCE Social Finance, amongst others.

I’m sharing (and touting) the investment amounts to show how capital efficient they’ve been, spending less than $1 of investment capital per $1 of annual revenues. They are also all profitable.

I challenge every venture capital or private equity fund manager to show similar stories of growth, at this speed, at this scale. I’m sure it has been done before, somewhere, but I’ve never seen it documented like this. More typically are venture capital funds touting their 1-in-a-fund unicorn. This is 7 out of the 27 companies that have ever been on an Africa Eats portfolio map (three of which we included at the start but decided not to invest in). And that 1 in 4 ratio is just where this sits in 2023. There are many other bizi in the portfolio that will surpass $1 million in the next year or two or three, who have yet to get the money and attention of these seven, as money and attention are both limited resources.