Ensibuuko

Watch David Opio pitch Ensibuuko live on the Fledge Demo Day stage:

Slide-by-slide through a traditional investor pitch:

“Like access to food, water, and shelter, access to financial services is a basic human right. Hello. My name is David Opio, founder of Ensibuuko, a financial technology company from Uganda.”

“Worldwide, one billion people are smallholder farmers. Farming is in fact the world’s biggest industry. The problem is that nearly all of the farmers are ‘smallholder’ farmers with little savings. The local banks don’t give them the loans they need to grow their businesses.”

“In Uganda, 80% of the population are rural farmers and are un-banked. My mother is one of these farmers. She owns ten acres of land but can afford to farm on only two. Her situation is far from unique.”

“In Uganda, the solution for rural farmers is the Savings and Credit Co-ops, known as SACCOS. They are typically organized by the farmers, who pool their savings and provide loans to the members. However, today, most of these organizations operate using paper and paperwork, which leads to losses from errors and corruption.”

“To modernize SACCOS, Ensibuuko has built MOBIS, the Mobile Banking and Information Software. MOBIS brings the SACCOS accounts into the cloud and makes those accounts accessible by mobile phone.”

“With MOBIS, every deposit comes with a text message and an updated balance that isn’t just written down on a paper ledger. Every deposit and loan repayment becomes part of a financial record that can be used by the farmers to show their good credit.”

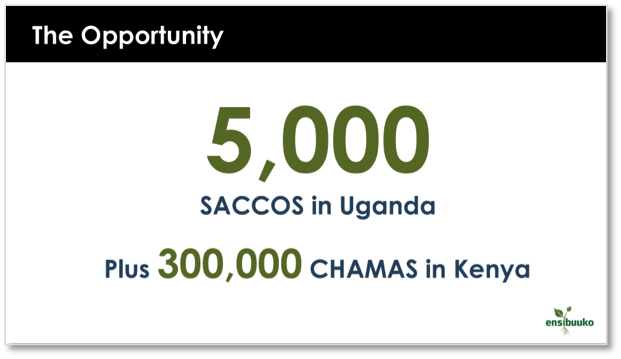

“There are over 5,000 SACCOS operating in Uganda plus another 300,000 in Kenya, where they are known as CHAMAS. And these co-ops are commonplace across all of East Africa.”

“Our business model is simple. We charge each SACCO a flat rate of $1,000 per year for the use of MOBIS, then charge 0.5% for each deposit, withdrawal, or other transaction by the farmers.”

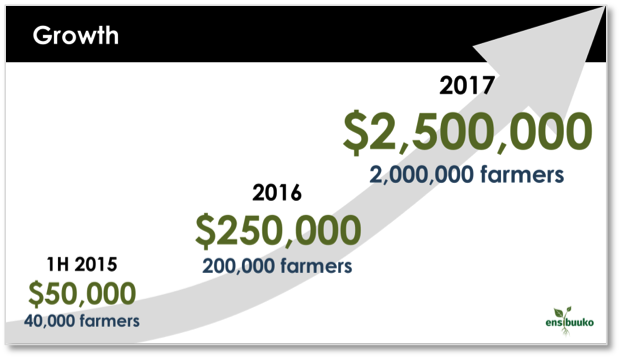

“In the first nine months since launch, we’ve signed up 500 SACCOS. 40,000 of their customers are now using MOBIS. We’ve processed $500,000 in savings from these farmers and are managing $200,000 in loans through the system.”

“Our goal is to reach two million farmers by 2017. Reaching that goal will grow revenues to two and a half million dollars. We are confident in this goal, as it requires sales to less than a quarter of all the SACCOs and assumes the revenues from only the existing MOBIS services.”

“The Ensibuuko team is well experienced in this field. This is Opio’s third startup. Both he and Gerald are not just trained in finance; they are also part-time farmers and thus directly understand the issues facing other farmers. The same is true for the other six members of the team, who spend most of their days out in the field talking with SACCOS, which, remember, are co-operatives run by other farmers, not bankers.”

“Reaching our goal of two million farmers requires $250,000 of investments. This is being raised as preferred shares, at $1 million pre-money valuation, with the first $75,000 already committed. The use of these funds is to create additional revenue-generating services within MOBIS, while expanding our marketing and sales efforts to reach all 5,000 SACCOS in Uganda, as well as some CHAMAS in Kenya.”

“That is all the time we have for questions today. Ladies and gentlemen, access to finance is a basic need, and at Ensibuuko our goal is to deliver financial inclusion to the hundreds of millions of smallholder farmers across Africa, starting with those in Uganda. I welcome you to join us in this quest. Thank you.”