It is not easy being a startup investor, and even more so as an impact investor.

In the tech sector, ask an Angel or VC how they choose their investments, and the most common answer is: team, team, team, team, team… idea. Push them on that an you’ll find one other unspoken criteria hiding at the start: opportunity size.

In the impact sector, things get far more complicated. Which is more important, team, impact, or financial return?

Twice per year that is my big question, as twice per year I narrow down hundreds of applicants to the seven invitees of Fledge, my conscious company accelerator. Each of these invitations comes with an investment, and thus this process is a genuine impact investing conundrum, one that attempts to balance impact and financial return.

The stated criteria for Fledge, in order of importance are: team, impact, and odds of (financial) success. The reality is far more complex, and more interesting. The reality resembles rock, paper, scissors.

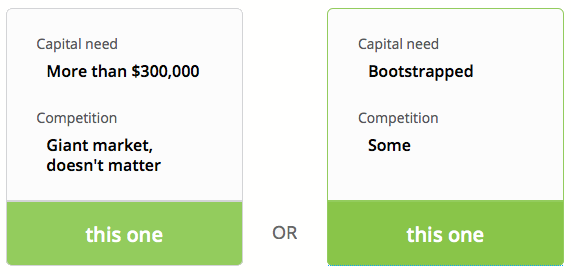

Not literally a rock, paper, scissors tournament between applicants, but instead a mathematically rigorous decision process where the various criteria add together to create a weighted ranking for each applicant. That description sounds overly complex, and it would be if not for 1000minds.com, which does all the complicated math. It’s a tool that (over and over again) asks you to pick the better choice, e.g.:

The interesting part of this process is how the various criteria act like rock, paper, scissors: a great team beats a global impact, global impact beats little competition, lack of competition beats capital need, a bootstrapping company (i.e. no need for capital) beats a company with some customers, a company with meaningful revenues beats the ideal team, and so on.

If only every applicant had a great team working on a global impact with no need for capital and no competition, there would be no need for all the math. Unfortunately, real applicants have a mix of strong points and weak points, and this battle of people (team), planet (impact), and profits spirals around to make the difficult decision of which are the most investable companies.

And the entrepreneurs thought their job was hard!

[…] It is not easy being a startup investor, and even more so as an impact investor. In the tech sector, ask an Angel or VC how they choose their investments, and the most common answer is: team, team,… […]