It is incredibly useful in business decisions to have a financial model, and a critical (but often overlooked) step for startup fundraising.

That said, over the last decade I’ve worked with thousands of entrepreneurs whose favorite Office tool isn’t Excel, who don’t know how to analyze someone else’s financials let alone create a financial model from scratch.

It isn’t that hard. The key is to remember that what you want is the simplest possible model that answers the questions at hand. In financial planning, the simplest model that suffices is much better than a complex model that is slightly more accurate.

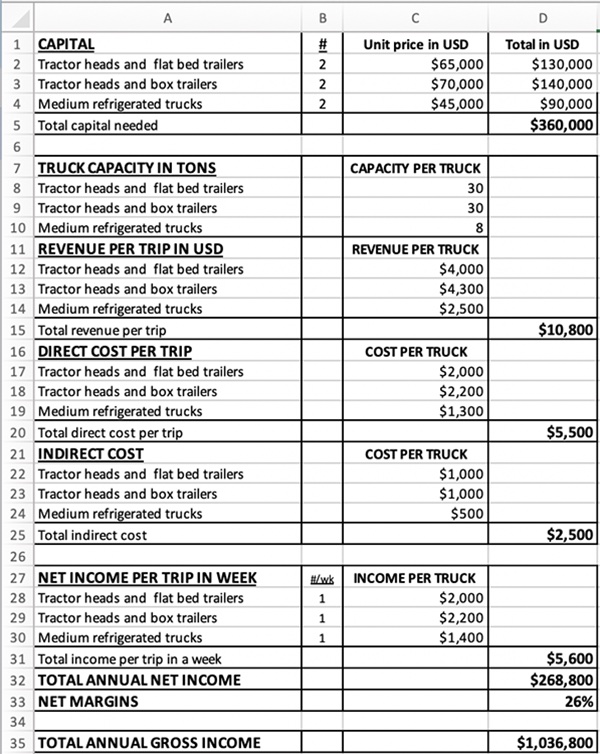

Case in point, one of my Africa Eats companies needs more trucks.

The simple questions they and we needed to know: How much will the trucks cost? How much more revenue will they generate? What are the estimated profits/(losses)?

All those questions are answered in a model that fits in one page. $360,000 of investments generate a little more than $1 million in annual revenue, at an estimated 26% profit.

Given that, and given a likely cost of capital less than half that 26% margin, this ask got a green light with little further discussion.

So the next time someone asks you for a financial model, or the next time you need to make a similar business decision for your own company, take the hour or two to make a simple financial model, and see for yourself how powerful that tool that can. Just remember to keep it as simple as possible.