It feels like venture capital has been around forever. Forever as in at least a few hundred years, if not thousands, no? No. Venture capital as talked about and practiced today has only been around since 1959. It is younger than my parents. And it wasn’t a $1+ billion industry until the 1980s, when I was in high school.

This is part 1 of a series.

- The (Lost) History of Venture Capital

- Venture Capital Took Decades to be Significant

- Arthur Rock helped invent Venture Capital

How did startup companies get funded before VCs? The same way they get funded today, by high-net-worth individuals (HNW) and families. What today we’d call Angel investors.

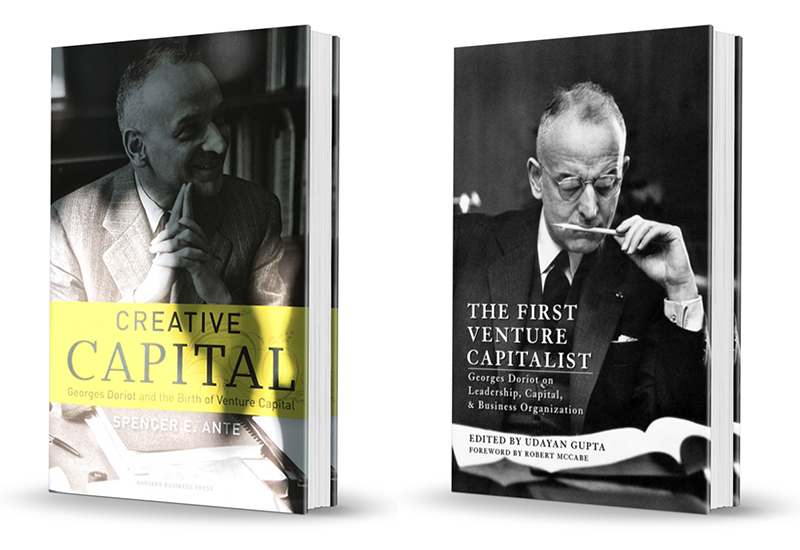

The first institution that kicked off modern venture capital was American Research and Development (ARDC), founded in 1946 by a professor from Harvard Business School, George Doroit, who was also a general in the US Army in WWII heading up logistics, and CEO of multiple compaines. A true renaissance businessman.

So why did I say venture capital start in 1959? Because ARDC wasn’t organized as a fund, and it didn’t always take minority ownership in its investees. In fact, it’s most famous investment was Digital Equipment Corporation (DEC), and ARDC owned 77%.

Nonetheless, Doroit was the father of venture capital, as the first three venture capital funds were set up by his colleagues from the US Army, his students from HBS, or his staff at ARDC.

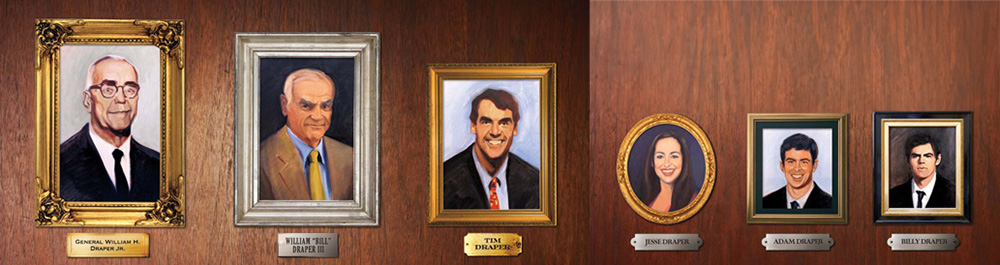

The first modern venture capital fund was Draper, Gaither, and Anderson. General Draper worked with Doroit in the US Army during WWII. After the war Draper was part of the team that ran the Marshall Plan. Draper’s son joined the firm too, leaving in 1962 to form Draper & Johnson, and then in 1965 founding Sutter Hill Ventures, which still exists today. Venture capital is the Draper family business, with Tim Draper founding Draper Fisher Jurvetson in the 1980s, which today is rebranded as Draper Associates.

Back to Draper, Gaither, and Anderson, this was a $6 million fund organized as a 10-year limited partnership with a 2.5% annual management fee and 20% carried interest for the general partners. The typical management fee is now 2% (or slightly lower for the billion dollar funds) but this “2&20/10+” structure is exactly the same as nearly all venture capital funds use today.

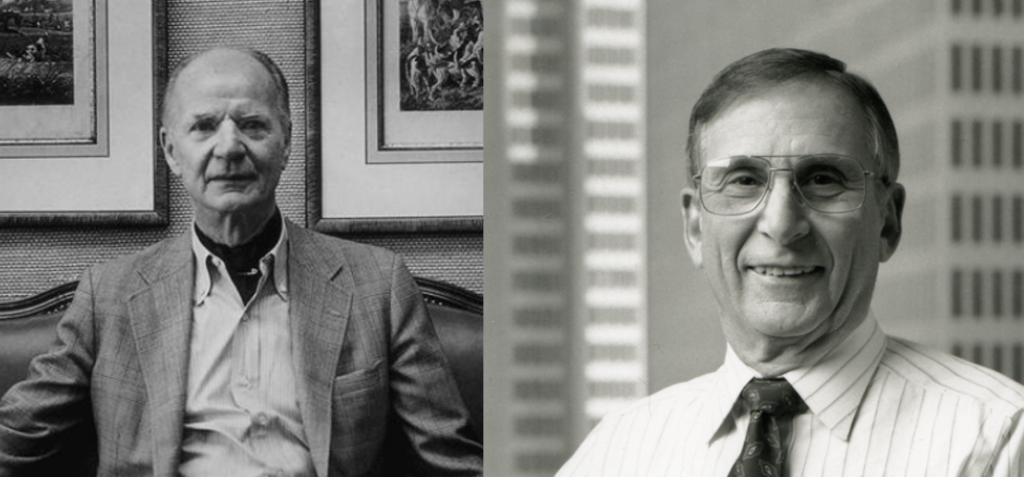

Jumping back to 1961, the second venture capital fund was Davis & Rock, created by two HBS alumni, Thomas Davis and Arthur Rock.

This was again organized as a 2&20 fund with just a few million dollars of capital.

Like the Draper funds, it too was based in the suburbs south of San Francisco, in what today is known as Silicon Valley. And yes, Davis & Rock not only invested in tech startups, they invested in some of the pioneers that put the silicon in Silicon Valley: Fairchild and Intel. Also like the first two Draper funds, this partnership did not last the full 10 years. Davis went on in 1969 to found Mayfield, which continues to be a top venture capital fund. Rock became an Angel, most famously backing the Apple Computer Company in the late 1970s, as one of its first few investors.

The third-ever venture capital fund was founded in 1965 in Cambridge, Massachusetts, near the Harvard and MIT campuses, by Bill Elfers and Dan Gregory, both of whom worked for Doiroit at ARDC.

Greylock Partners is still around today, but they moved to Silicon Valley in 2009.

What all these early funds had in common, beyond the 2&20 structure was: tiny amounts of capital, an appetite for risk in yet-proven technologies, and a mindset to break from the past to invest in new ways. Looking back at venture capital here in the 2020s, little of that is true for today’s venture capital funds.

More on what changed in future posts…

Africa Eats is an investment company...

Africa Eats is an investment company...