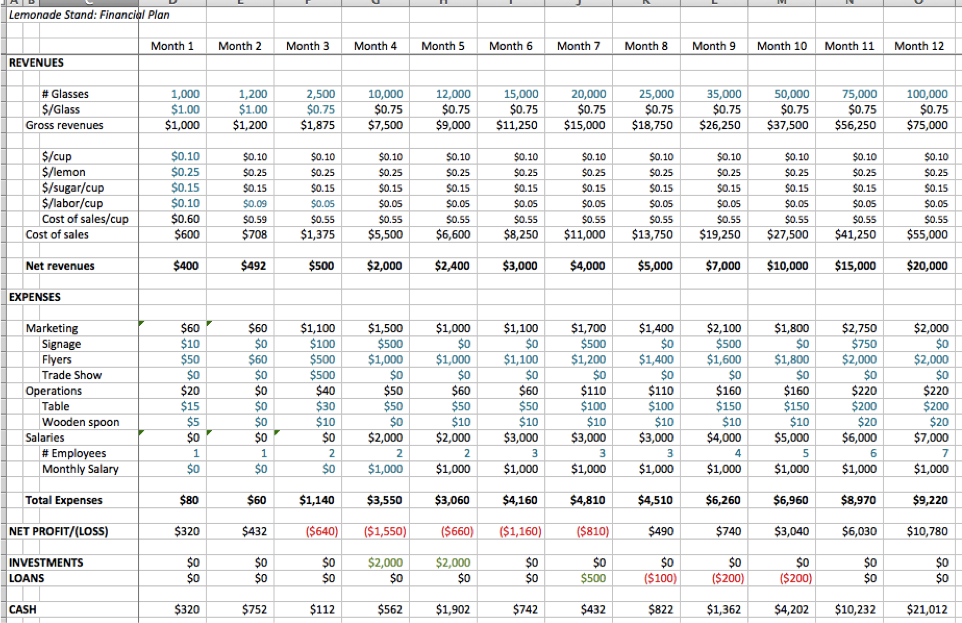

Continue for the next eight months. Month by month, begin by estimating the revenues. If needed, adjust the cost of goods. Think about how the expenses change as the number of sales increase.

For Year 1, the typical pattern is that, each month, you have higher revenues and expenses, and, for most companies, you also have higher losses each month.

For this lemonade business, in Month 5, with sales growing 20% to 12,000 glasses, the losses are $600, and, despite rounding up the investment in Month 4, we run out of cash again. Thus, for Month 5, another $2,000 in investment is needed.

Note that, in the real world, when you are raising money from investors, you do not raise it in small, piecemeal amounts as needed but rather take the sum of all the investment needs, round that up, and aim to raise it all before any investment is needed. For this lemonade business, that means adding the $2,000 from Month 4 to the $2,000 from Month 5, rounding it up to $5,000, and aiming to raise it during Month 3.

Moving on. In Month 6, sales grow 25% to 15,000 glasses, and, due to the addition of a third employee, the losses do not just continue, they grow. However, like in Month 3, we still have enough cash in the bank to absorb those losses, thus no additional investment is needed.

In Month 7, sales grow to 20,000 glasses (double from Month 4), and we have one loss before “turning the corner” and seeing profits in every month for the remainder of the year. We are short only $100 in cash for that month, thus, rather than finding another investor, we turn to a friend and borrow $500.

Since this $500 is a loan, it goes on the line labeled “loans.” When the money comes in, I color it green. When we start paying back the loan, I color the cell red. In Month 8, we pay back $100 of the loan. In Months 9, we pay back $200, and by Month 10, we plan to finish paying off the loan. Since our friend asks for no interest for this very short-term, three-month loan, we simply show a monthly repayment of $100 or $200 on that same line in the model, and each repayment is a negative number (which appears in red in my spreadsheet).

If you take out a bank loan instead of asking a friend, you might add two more lines to your financial model: one for repayment of the principal, and another for the interest expenses. Same thing for using a line of credit or credit card.

Back to the lemonade business. Months 8, 9, 10, 11, and 12 continue to grow sales, and each month increases the expenses to match the increased level of sales.

By the time we get to Month 12, this business is projected to sell 100,000 glasses of lemonade, earning $75,000 in revenues with a staff of seven, a monthly net profit of $10,780, and $21,012 in cash in the bank.

That is quite a change from the $320 profit in Month 1.

Is this plan realistic? Can you imagine selling 100,000 glasses of lemonade? Is a staff of seven people big enough to do that? Has enough been spent on marketing to drive that level of business? Or too much? What other expenses are missing?

These are the types of questions you should be asking about this plan, and you should ask the same questions about your own plan.