Grab a pen and the back of an envelope…

Earlier in Steps 10, 11 and 12, we did some rough calculations to decide if we could sell the product to enough people for enough money to make it worthwhile to even think about. Now we are ready to fine tune our initial estimates.

QUESTION 42:

Can this be a profitable venture?

A full financial plan includes the expenses for everything per month, listed out for at least three years. Before embarking on that complex effort, we can first determine if this venture has a chance of profitability with a relatively quick, “back-of-the-envelope” financial plan.

Skip past the initial growth phase, and use only your year three projections:

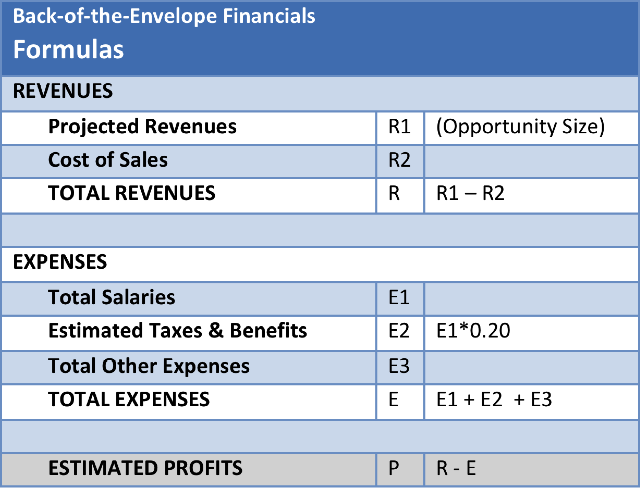

EXPENSES (money going out to run your business)

- List out all of the people you expect to hire, and each of their expected annual salaries

- Add 20% to this number to cover taxes and benefits

- List out all the other major annual expenses required to get the product ready for market, e.g., rent, licenses, patent filing fees, accounting, legal, public relations, etc.

REVENUES (money coming in from customers)

- Take the number of annual sales and the average price of each sale that you estimated in Step 12 (“Opportunity Size”)

- Subtract the cost of making the product (a.k.a. “cost of sales”)

PROFITS Take the revenue number, subtract the total expenses, and see if you have a positive number. If not, go back through your financial assumptions and revise.

This simple exercise will help you understand whether the company will ever be profitable and, if so, if those profits are sufficient to make you interested in building the business. Specifically, if you cannot find a reasonable number of sales to offset a minimally-sized team, you have found a flaw in your business model.

If so, do not fret. It is common to find a solution to a problem but no way to actually make a profit selling that solution. Before giving up, step back, rethink your assumptions. When re-planning, try thinking out-of-the-box.

It is far better to do this process now rather than a year from now, with a product in the market making sales but with a company losing money on every sale and no way to ever reach profitability.

Filling in the above template for Bird Watch:

The Bird Watch financials do not look promising. The estimated expenses are far higher than the projected revenues. In fact, the estimated revenues are not even sufficient to cover the costs of the two employees. Shrinking the company to a single employee is not feasible, nor is halving the salaries. (Note the salaries are below-market rate for Seattle, where the founders live. This business might be viable in another city or country with a lower cost of living.)

Bird Watch does provide a useful solution to an existing problem. However, the market size is just too small to make for a viable business. This likely explains why there is so little competition.

Given this result, the next step is a step backwards, to return to the chapters on market sizing and pricing. More likely than not, that will be insufficient. Instead, this plan will probably need to be expanded into a new market, beyond tracking wildlife. If there is another market with a problem worth solving that can be solved by the Bird Watch tags and base stations with little or no changes to the technology, and that would generate far more than $300,000 worth of revenues, then all hope is not lost for this plan. To see how this might work, see the “Example Plan: Bird Watch” chapter in the appendix, where one such alternative plan is explored.

“Pivoting” a plan into a new market or “pivoting” a product to solve a different problem is a very common practice when planning a startup. In fact, nearly all successful name-brand companies succeeded not on their original business plans but with their second, third, or tenth revision of their plans. This includes companies like Starbucks, PayPal, Facebook, and Coca-Cola.

For details on how to build this financial model from scratch, read the companion guide, The Next Step: A guide to building a startup financial plan, and/or watch the related Next Step class: Lesson 5. The Financial Model.

Further Reading

Getting to Plan B, John Mullins and Randy Komisar

Plan B: How to Hatch a Second Plan That’s Always Better Than Your First by David Murray