It takes money to make money.

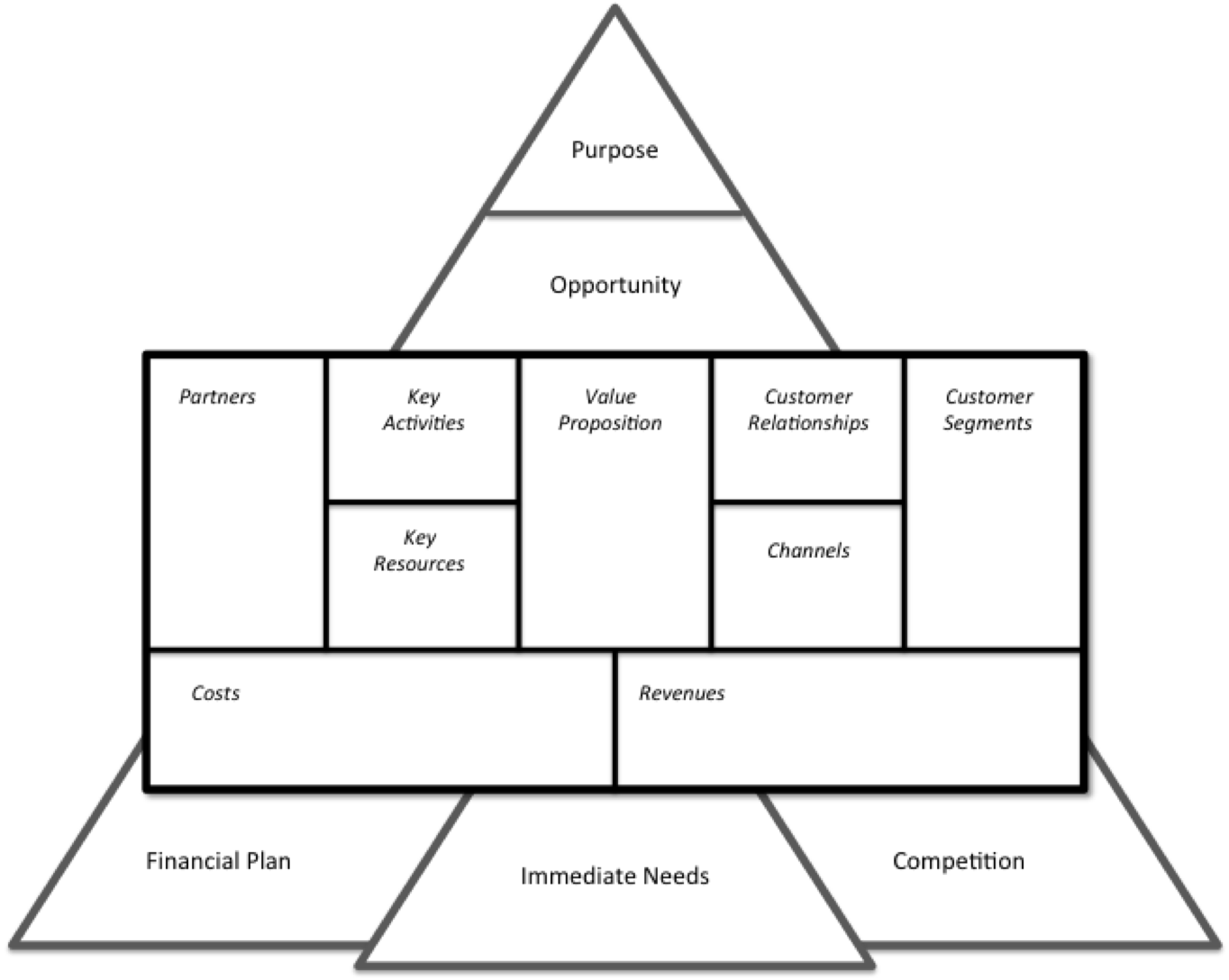

The Revenues and Costs boxes in the Business Model Canvas are usually just descriptions of how the company makes and spends money. In the most detailed Canvases I’ve seen, they are snapshots of revenue and cost projections.

What is missing is an answer to three crucial questions: Can this business ever make a profit? If so, when will that be, and how much cash will it take to get there?

The only way to answer these questions is to create a startup financial plan. The Next Step: A guide to building a startup financial plan walks you through the process of how to do this.

In the Business Presentation Pyramid, the Financial Plan box is purposefully placed at a corner, as it is a cornerstone of the business planning process.

If the company can never earn a profit, then it is not worth pursuing. If it will take ten years to earn that profit and you do not personally have enough money or enough patience to wait that long, the business is not going to succeed.

Many entrepreneurs find it scary to look at a blank spreadsheet with the task of fleshing out five years’ projections. All entrepreneurs I’ve ever met who have made it through that step look back and laugh at the pages of “made up” numbers that go into such a plan.

The truth, however, is that generating the financial model will, at the very least, teach you how the dollars flow through your business. Yes, the numbers are all going to change. However, like iterating on the Canvas, doing the exercise will leave you with a much better understanding of how your business will likely work and what might cause it to fail.