It feels like venture capital has been around forever. Forever as in at least a few hundred years, if not thousands, no? No. Venture capital as talked about and practiced today has only been around since 1959. It is younger than my parents. And it wasn’t a $1+ billion industry until the 1980s, when I was in high school. This is part 2 of a series and will focus on that slow growth of the industry, and what has happened since.

- The (Lost) History of Venture Capital

- Venture Capital Took Decades to be Significant

- Arthur Rock helped invent Venture Capital

The first few venture capital funds were tiny. Draper, Gaither, and Anderson had $6 million of capital, provided by just three families. Davis & Rock raised just $5 million, but they disbanded after only deploying $3 million. Greylock raised and invested $10 million.

Yes, if we convert these amounts into 2023 dollars, they are about 10 times bigger. But a $60 million venture capital fund today is considered a small “seed” fund, not a “real” fund. A real, “full scale” venture capital fund is at least $200 million, if not $500 million or $1 billion.

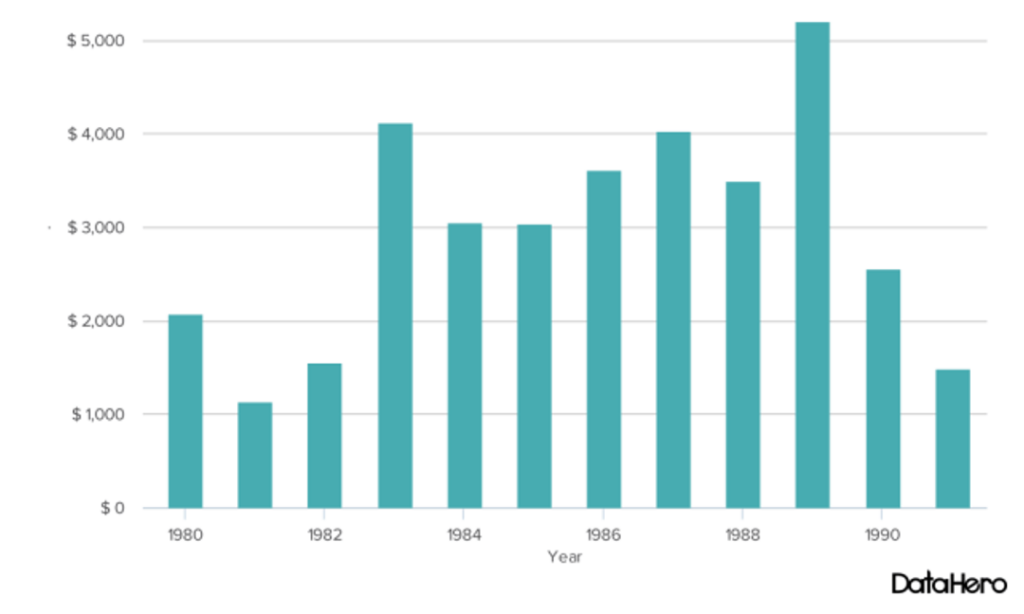

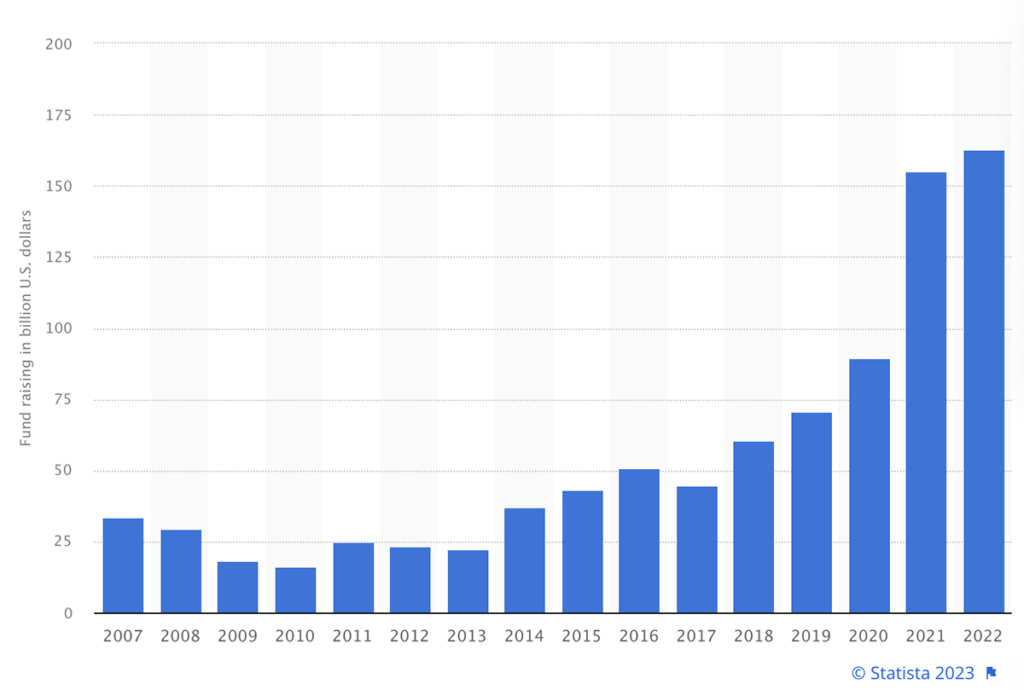

I couldn’t find statistics online for the size of the VC industry in the 1960s and 1970s. There were a handful of other VC funds started in the 1960s, so we can estimate the total for the whole decade was no likely around $150 million. What is visible online is year-by-year aggregates for the 1980s, and every year since.

In 1980, $2 billion was raised into venture capital funds. There were some ups and down across the decade, with a drop in the recession years of 1990 and 1991, but the general trend was upward and the average for the decade was in the small single digit millions.

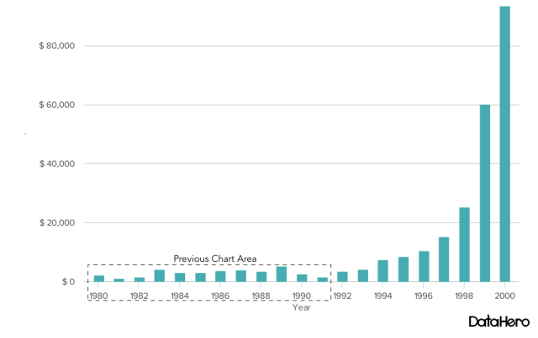

The growth in the 1990s was dramatic. The graph from the 1980s is shown above, and the year-to-year fluctuations are “in the noise” as the exponential growth of venture capital took off.

Before I did this research, I had no idea that the dot com bubble coincided with the maturity of the venture capital industry. When the first VC knocked on my door at my first startup in 1992, I thought venture capital had been around forever and that they had most of the investment capital. When my VC-backed company filed to go public in 2000, just as the dot-com bubble burst, I had no idea the venture capital industry had grown 50-fold in those previous eight years.

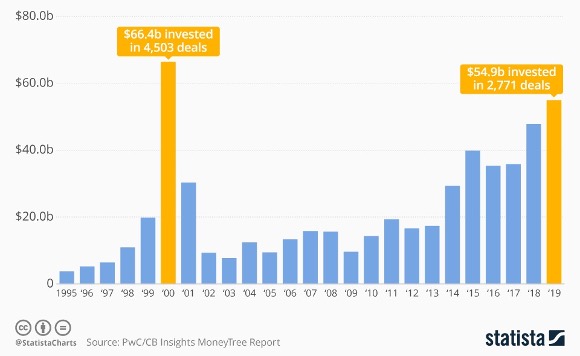

The reality is that 2000 was a high water mark for venture capital, not again replicated until 2020. The industry shrunk dramatically after the dot-com crash and it took a decade before multiple tens of billions of dollars was flowing again through venture capital funds.

Once again, in the 2020s, venture capital is seeing another bout of exponential growth. Scroll up and compare how big 2019 looks in the 1995-2009 graph and how small it looks in the 2007-2022 graph.

So… looking back… the first decades of venture capital (in 2023 dollars) were smaller in scale than single years today. What was an industry measured in millions in now an industry measured in billions.

Does the industry deserve those billions??? We’ll see in the next post…