What is the story with the unicorns? Is there a tech investment bubble? What on earth is going in in the venture investing world?

The short answer is that we’re at a crux of a paradigm. The paradigm wrapped around investing venture capital in startups.

Few people I talk to know that venture capital, as practiced today, is a fairly new concept. People instead assume its been around forever. It only really started in the 1970’s, but was a tiny industry until the 1980’s.

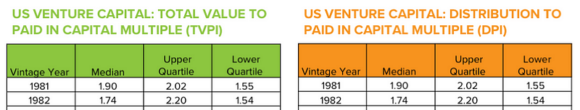

Venture capital’s key investment distinction is that it is high risk, and thus expects high rewards. Trouble is, since the dot com crash in 2001, it has not provided those returns, at least not for most VCs and not for the industry as a whole.

The root cause of today’s trouble is that the venture capital industry, along with most of the Angel community following along a paradigm that works for less than 0.1% of all startups. That paradigm is to (a) find billion dollar market opportunities, (b) high growth business plans, and (c) pitched by great teams of entrepreneurs who can execute that business. If all that goes well, then the investors earn a 10x or 20x or 500x return on their investment.

Trouble is that less than 1 out of every 1,000 companies fit the first criteria, the billion dollar opportunity. Trouble is that neither the investors nor the entrepreneurs can tell the hits from the duds. And even when the opportunity size is obvious, trouble is so much can go wrong in reaching that market that even great teams often fail. And that assumes we can tell in a few hours if we’re truly investing in a great team.

I’ve written before about how this unicorn-seeking frenzy does nothing positive for the majority of the startups. The ones with big but not huge opportunities.

This “California Capitalism” paradigm is so pervasive that few investors bother to consider alternatives. They don’t see that their investment thesis is a choice, not a law of nature. They don’t see that their investment structures cause the low returns of the industry.

They don’t see that there are other choices, that will produce better results for more startups.

It’s frustrating to see all the naked emperor investors, and especially hearing their woes about have no more money to invest, as its all tied up waiting around for exits. My solace is the knowledge that broken paradigms eventually shift, after enough evidence piles up that they are broken. The coming unicorpses are hopefully enough to start that shift.

UPDATE: I’ve given talk wrapped around this idea dozens of times. A copy of the slides are available here, the revenue-based analysis spreadsheet is here, and a recording of my talk on this topic is below. The full revenue-based workshop can be found on this other blog post.

A deep industry analysis on why traditional venture capital isn’t, in general, working:

[…] “California Capital” […]