Assume a spherical cow…

A key part of that storytelling is separating your assumptions from your conclusions. Make your assumptions easy to see and, at the same time, easy to change.

In accounting, we use spreadsheets to record events that have already happened, such as the number of products that were sold last quarter. In that case, the numbers that went into the spreadsheet were already established.

However, in a financial plan, we do not describe the past, but, rather, the future. We are creating projections about things that have not happened yet. Therefore, many of the numbers that go into the spreadsheet are educated guesses, and are likely to change.

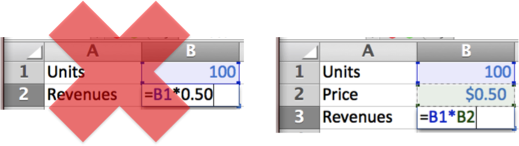

These educated guesses are the assumptions in your plan. The estimated number of sales. The estimated size of expenses. The projected number of employees. And so on. To make it obvious which numbers are assumptions, in my spreadsheets I color all the assumptions in blue.

Everything else in the spreadsheet I leave in black. This means that all the rest of the numbers on the spreadsheet, those that are not blue, are values computed via formula. This includes projected values and calculations based on the assumptions.

These formulas should be as simple as possible. With only a few exceptions, the formulas do not contain any numbers but, instead, simply point to cells; they copy, add, subtract, multiply, or divide the contents of the cells. This is key!

For example, the formula (below) computes the total revenues (money coming in from customers). It does this by taking the number of units sold and multiplying that by the price. “Number of units sold” is an educated guess about the number of units you will sell in the future. It is an assumption, and it might be wrong. The price is also an assumption that you might decide to change later. Thus, the number of units is visible on the spreadsheet in blue, and so is the price. To calculate revenues, the formula simply multiplies them together.

This may seem simple and obvious, but many entrepreneurs I’ve met include numbers and prices within their formula. In practice, this makes it difficult or impossible to understand where their totals come from. You are forced to navigate through their spreadsheet, looking at every formula to find the hidden assumptions. In short, these spreadsheets fail to tell a story, since they fail to logically describe how all the assumptions fit together. Do not do this!

The one exception to this rule is formulas that deal with time. If you are converting a value from a monthly amount to an annual amount, your formula can multiple the number by twelve. If you are converting a quarterly amount to monthly, your formula can divide by three. This is because there are always three months in a quarter and twelve months in a year. These numbers are well-known and never change.

If your spreadsheet contains monthly, quarterly, and annual data (and most financial plans do), then make sure the timeframe for each value is clearly labeled.