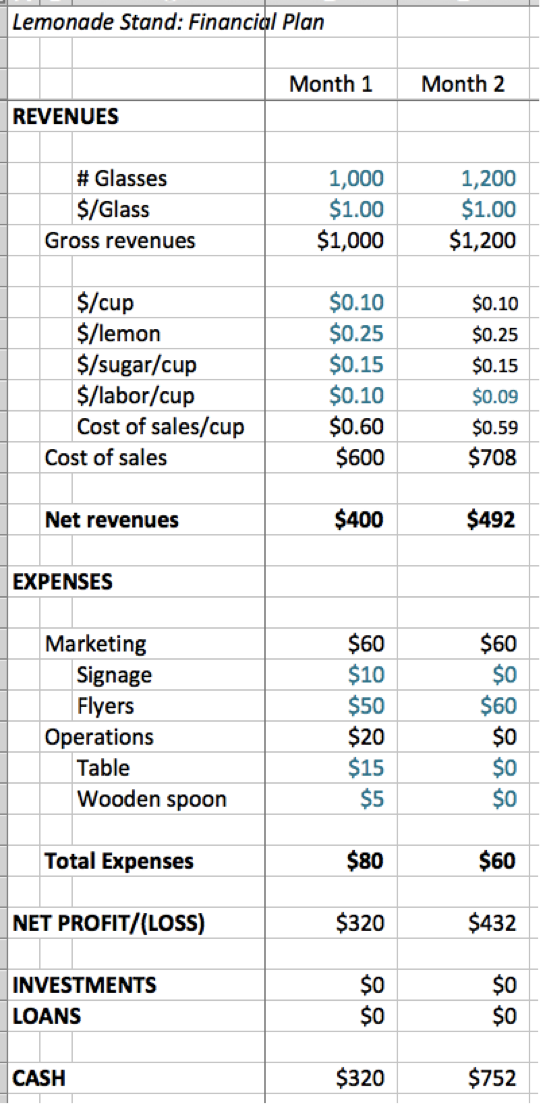

Onward to the second month. As you go through from month to month, spend some time looking at and thinking about your estimates. But not too much time. There will plenty of time later, as you iterate through the plan to question every value and fine-tune your estimates. It is more important in this first pass to get an initial first draft of estimates as quickly as possible, so you can prove to yourself that the business is worth pursuing.

For our lemonade business, like most businesses, there are fewer assumptions in Month 2 versus Month 1. Most of the numbers stay the same. Since the financial model is in a spreadsheet, and since we will be changing numbers later, don’t copy the numeric values from Month 1 to Month 2. Instead, use a formula that copies the values for us.

For example, the “$/cup” in the cost of goods in Month 2 uses the formula “=D10,” where “D10” is the name of the cell with the “$/cup” value from Month 1. With this formula, if we change the price per cup to $0.09 in Month 1, it will automatically change in Month 2.

Make sure the values computed by these (simple) formulas are colored black, since they are computed. With that coloring in place, when you see a number in black in a new column next to a number in blue in last month’s column, you will instantly know that the value in black is unchanged from month to month (or quarter to quarter).

In the estimates for Month 2, we predict we will sell more glasses of lemonade, growing from 1,000 to 1,200. It is assumed that we will have the same number of employees, even with this growth in sales, and thus the cost per cup in labor goes down slightly, from $.10 per cup for labor to $.09 per cup. (The same number of people are working the same amount of time but selling more cups.)

Regarding the other fixed expenses, we don’t need another table or sign or a new spoon, thus our only expense is more flyers.

With these estimates in place, the “bottom line” (another name for the net profit) is a profit of $432. What a great business!

We still haven’t received any investments or loans, thus we have another $432 to deposit into our bank account. The cash line, as explained above, is the balance of this fictional bank account. It is the sum of the previous balance, $320, plus our net profit, $432, plus any investments and loans, $0; a total of $752.

At this point, you might think this is a near-perfect business. Two months of projections, and two months of profits. Before you get too excited, note there is a lot more work to do to understand how this business operates at scale.